Worldwide air cargo tonnages dropped further in the first week of 2024 following their typical slump in the second half of December, according to the latest figures from WorldACD Market Data, although the New Year decline most likely reflects the inclusion of 1 January in the week 1 figure.

Weekly analysis

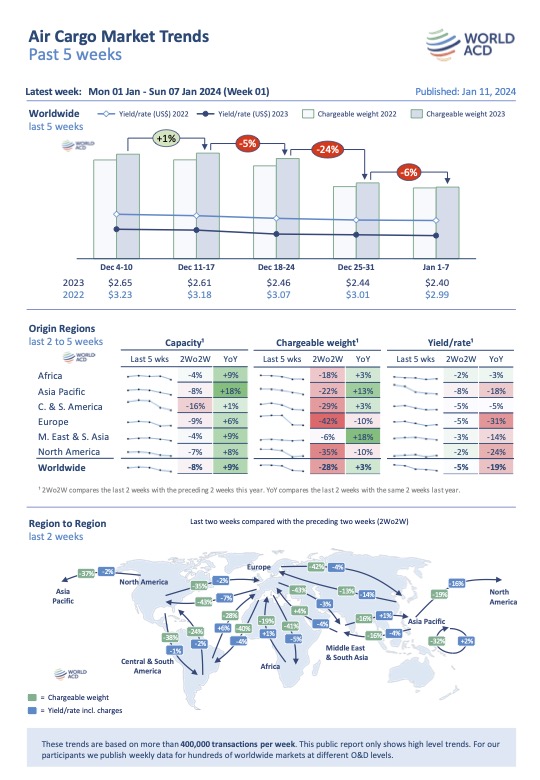

Preliminary figures for week 1 (1 to 7 January) indicate that global air cargo tonnages fell -6% compared with the previous week (WoW), based on the more than 400,000 weekly transactions covered by WorldACD’s data, after falling by around -30% in the second half of last month, while average worldwide rates dropped by around -2% in the first week of 2024 after falling by around -7% in the second half of December. The main lanes that contributed to the WoW decline in tonnages of -6%, were ex-Asia Pacific to, respectively, North America and Middle East & South Asia (both -17%), and intra-Asia Pacific (-13%).

The global WoW patterns are broadly similar to those of previous years, although tonnages in the first week of 2023 remained stable compared with those of the previous week, whereas this year they continued falling. However, it’s worth pointing out that week 1 last year (2-8 Jan) was a ‘normal’ working week as it excluded 1 January – a holiday in many parts of the world – whereas this year’s week 1 (1-7 January) included 1 January, potentially explaining this year’s week 1 tonnage decline.

Expanding the comparison period to two weeks, total combined tonnages for week 52 of 2023 and week 1 this year were down by -28% compared with the preceding two weeks (2Wo2W), and average rates fell by -5%, with capacity down -8%.

While volumes went down significantly across all regions, on a 2Wo2W basis, there were particularly big tonnage declines ex-Europe (-42%) and North America (-35%), followed by ex-Central & South America (-29%), ex-Asia Pacific (-22%) and ex-Africa (-18%), and a more-modest fall ex-Middle East & South Asia (-6%).

There were also double-digit percentage declines on almost all the major intercontinental lanes, with drops of -40% or more on all the main corridors ex-Europe, including on the North Atlantic (-43% westbound, -35% eastbound), to Asia Pacific (-42% eastbound, -13% westbound), to Africa (-41% southbound, -19% northbound, and to Central & South America (-40% southbound, -28% northbound). Traffic ex-North America was down by more than -30% on its other main export lanes, including to Central & South America (-38% southbound, -24% northbound), and to Asia Pacific (-37%), although transpacific eastbound traffic held up better (-19%). Tonnages between Asia Pacific and Middle East & South Asia were also less affected by the end-of-year declines, but were still down -16% in both directions, while intra-Asia Pacific volumes fell by almost one-third (-32%), on a 2Wo2W basis.

On the pricing side, the -5% global average decline in the last two weeks was mainly driven by falling rates on the big lanes ex-Asia Pacific to North America (-16%) and Europe (-14%). Other markets recorded single-digit average percentage declines, except Central & South America to Europe (+6%), intra-Asia Pacific (+2%), Africa to Europe (+1%), and Middle East & South Asia to Asia Pacific (+1%), on a 2Wo2W basis.

Most of these patterns are similar to those in the equivalent two weeks a year ago, although the fall in rates ex-Asia Pacific to North America and Europe has been steeper in the last two weeks than a year ago, most likely reflecting a bigger spike in rates ex-Asia Pacific in the recent fourth quarter (Q4) of 2023 than was seen in Q4 of 2022.

Year-on-year perspective

Compared to the equivalent period a year ago, total global tonnages for week 52 of 2023 and week 1 this year were around +3% higher, year on year (YoY), led by double-digit percentage growth ex-Middle East & South Asia (+18%) and ex-Asia Pacific (+13%). These were more or less balanced out by declines of -10% ex-Europe and North America, while tonnages ex-Africa and ex-Central & South America saw modest increases (+3%), YoY.

Worldwide average rates are currently -19% below their levels this time last year, at an average of US$2.40 per kilo in week 1, although they remain significantly above pre-Covid levels (+30% compared to January 2019).

Meanwhile, overall available capacity has increased by +9% compared to the equivalent period a year ago, with capacity ex-Asia Pacific up by a noteworthy +18%. Most other regions also show significant YoY capacity increases, with a +9% rise ex-Middle East & South Asia and ex-Africa, a +8% capacity recovery ex-North America, and a +6% rise ex-Europe, with only a small (+1%) rise ex-Central & South America.