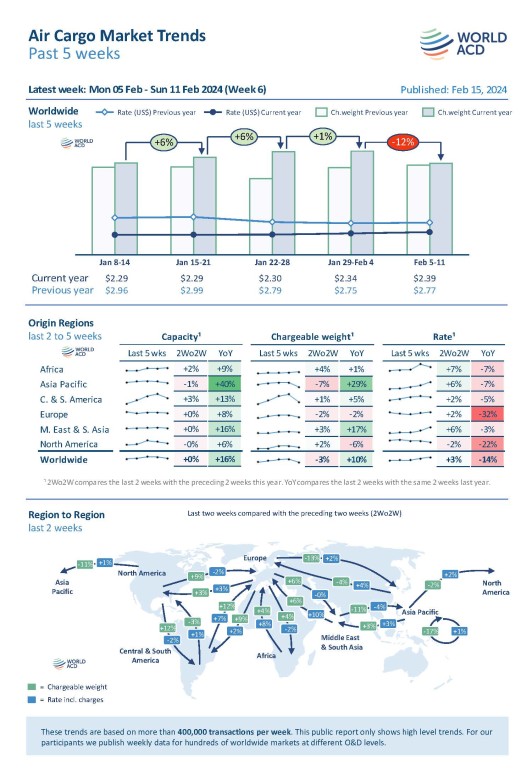

China’s air import tonnages dropped sharply in the final few days leading up to Lunar New Year (LNY) on 10 February, along with intra-Asia Pacific traffic, contributing to a

-12% fall in overall global tonnages, week on week, according to the latest figures from WorldACD Market Data.

Weekly analysis

Analysis of week 6 (5 to 11 February) indicates that China’s inbound air cargo tonnages slumped by -15%, week on week (WoW), in the seven days to 11 February, while the country’s outbound tonnages held up better with a decline of just -2% as the LNY holiday week approached. That follows a surge in tonnages and rates ex-China in the previous two weeks, as shippers rushed to get goods shipped before the LNY holiday period. Both inbound and outbound tonnages are expected to fall further this week.

Average global rates held firm and rose slightly in week 6, as they did in the equivalent week last year (week 3) ahead of LNY, based on the more than 400,000 weekly transactions covered by WorldACD’s data.

Initial analysis suggests that the patterns this year are broadly similar to last year, although global tonnages so far are well above last year’s levels. But the relative timings of LNY are significantly different, with LNY falling on 22 January last year, and a clearer picture will emerge by the end of this month.

Expanding the comparison period to two weeks, total combined tonnages for weeks 5 and 6 this year were down by -3%, globally, compared with the preceding two weeks (2Wo2W), with average rates up by +3% and capacity stable. Indeed, average rates were up, on a 2Wo2W basis, from all the main regions except North America (-2%), including rises of +7% ex-Africa and +6% ex-Asia Pacific and ex-Middle East & South Asia.

The -3% worldwide tonnage decline was largely driven by a -7% drop in tonnages from Asia Pacific origins – which, in turn, was mainly generated by a -17% fall in intra-Asia Pacific traffic, with the intra-Asia Pacific market apparently responding more quickly than the main long-haul markets to the arrival of the Lunar New Year holiday period. Indeed, ex-Asia Pacific tonnages to Europe and North America were down by just -4% and -2%, respectively, while tonnages to Middle East & South Asia rose by +3%. And on the much smaller lane from Asia Pacific to Central & South America, tonnages were up +15%, on a 2Wo2W basis.

Outbound tonnages from Europe also fell (-2%), on a 2Wo2W basis, mainly due to a -13% drop to Asia Pacific. But the other main origin regions recorded increases, including +4% ex-Africa, +3% ex-Middle East & South Asia, and +2% ex-North America. Tonnages from Central & South America also rose slightly (+1%), driven by a spike (+12%) in volumes to Europe, boosted by a late surge in flower exports ahead of Valentine’s Day on 14 February.

Other significant 2Wo2W changes on the main intercontinental lanes included a -11% drop from North America to Asia Pacific, balanced by a +12% rise from North America to Central & South America. Ex-Middle East & South Asia tonnages to Asia Pacific fell by -11%, but rose by +6% to Europe, accompanied by a +10% rise in average rates on that lane. That surge to Europe from Middle East & South Asia most likely reflects conversion of some Asia-Europe ocean freight to sea-air tonnages, due to the ongoing disruptions to container shipping in the Red Sea.

Year-on-year perspective

Year-on-year (YoY) comparisons show a +10% increase in worldwide tonnages for weeks 5 and 6 combined compared with last year, driven by a +29% rise in chargeable weight ex-Asia Pacific and a +17% increase ex-Middle East & South Asia. Those increases, especially ex-Asia Pacific, can be at least partly explained by the difference in the timing of LNY this year, although there are some continuing signs of an underlying improvement in tonnages compared with a year ago.

On the pricing side, average worldwide rates of US$2.39 per kilo in week 6 are -14% below their levels this time last year, one of the narrowest YoY gaps seen in the last 12 months. On a regional basis, average prices, respectively, from Africa, Asia Pacific, Central & South America, and Middle East & South Asia origins are all within single-digit percentages of their levels this time last year, although prices ex-Europe (-32%) and ex-North America (-22%) are well down on last year’s levels. Nevertheless, average global rates remain significantly above pre-Covid levels (+34% compared to February 2019).

Overall worldwide air cargo capacity remains significantly up on last year’s levels (+16%), boosted by a +40% rise ex-Asia Pacific, a +16% increase ex-Middle East & South Asia, and a +13% rise ex-Central & South America, although capacity from all the main regions is up, YoY.