A halt in Russian log exports and reduced wood demand in China contributed to a 20% decline in international softwood log trade in the 1H/22

Global trade of softwood logs plunged by 20% during the first half of 2022 y-o-y. Much of the decline was because of the Russian log export ban that came into effect on January 1, 2022. However, with weakening housing markets worldwide resulting in lower demand for lumber, other countries beyond Russia saw slowing exports of logs throughout the spring and early summer.

substantially this year. Out of the top 10 exporting countries in the world, only Norway, Poland, and Sweden increased their exports during the first six months of 2022. Norway increased shipments by almost 20% y-o-y, making them the fourth largest log-exporting country in the world. Most of this relative increase was in sales to Germany and Latvia. However, Sweden still imports the lion's share of overall log exports from Norway.

Longer term, pulplog exports to Sweden may be negatively affected if the new CTMP pulpmill that the Norwegian forest owner group Viken Skog and Swedish paper company

BillerudKorsnäs are considering building coming to fruition (the possible project is currently in a feasibility study phase).

Softwood log imports to China plunged from 23 million m3 in the 1H/21 to only 14 million m3 during the same period in 2022, reports the Wood Resource Quarterly. Although importation picked up in the 2Q/22, it was still the second-lowest quarterly volume in six years. A slowing economy and uncertainty in the financial markets kept the government and banks from investing in the housing sector, resulting in reduced demand for logs and lumber. Other countries that have reduced roundwood imports in the 1H/22 include Austria (-18% y-o-y), South Korea (-18%), and Germany (-11%).

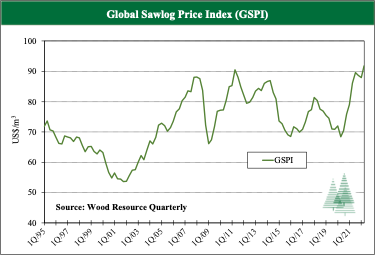

Global sawlog prices reach record highs

Sawlog prices increased worldwide in the 2Q/22 (in US dollar terms), except for Oceania and Northern Europe. The increase extends the upward trend that started in early 2020, just after prices had fallen to their lowest levels in over a decade.

Over the past two years, log prices have gone up the most in Central Europe (+82%), followed by Southeast Baltic Sea (+58%), North America (+33%), Latin America (+27%), and the Nordic countries (+20%). As a result, the Global Sawlog Price Index (GSPI), representing 20 regions worldwide, has gone up 34% from $68/m3 in the 2Q/20 to $92/m3 in the 2Q/22 (see chart). The current index is substantially higher than its ten-year average of $78/m3 and is the highest level on record since it was established in 1995.