Is 2023 the Comeback Year for the Auto Industry? Is it the real deal or a post-pandemic teaser?

Is 2023 the real Comeback Year for the global auto industry? Or is this year simply a teaser – a year of unfulfilled promise.

Still, even with historic high average prices for autos in 2022 – which left U.S. car dealerships awash in much needed cash – the question lingered over the sales recovery, was this the real deal or simply a post-pandemic consumer buying spree?

After all, over 17 million light vehicles were sold in the U.S. in 2017, 2018 and 2019 compared to the “surge” of 13.4 million units in the 2022 rebound. And it isn’t a question solely being asked in the U.S. In Europe in 2019 auto sales tallied 15.66 million units and only 10.15 million units in 2022, the lowest since 1993.

So, is this the beginning of a return to “normal” for the global auto industry or something else altogether?

Spinning Wheels: Finding Context in the Auto Industry

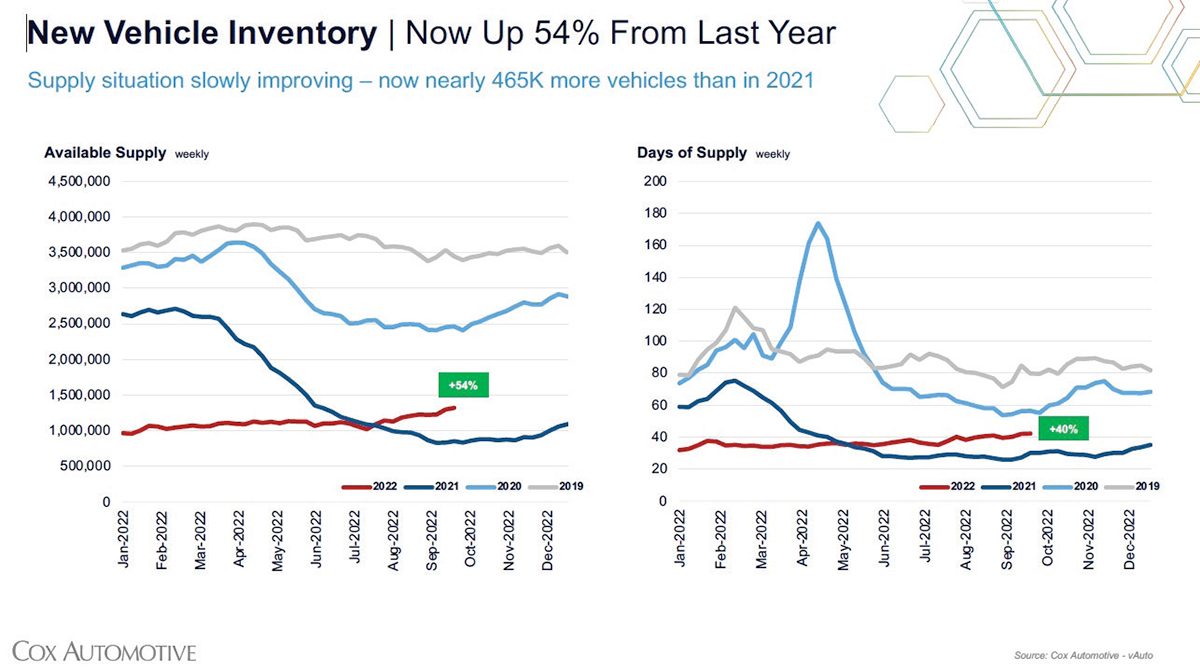

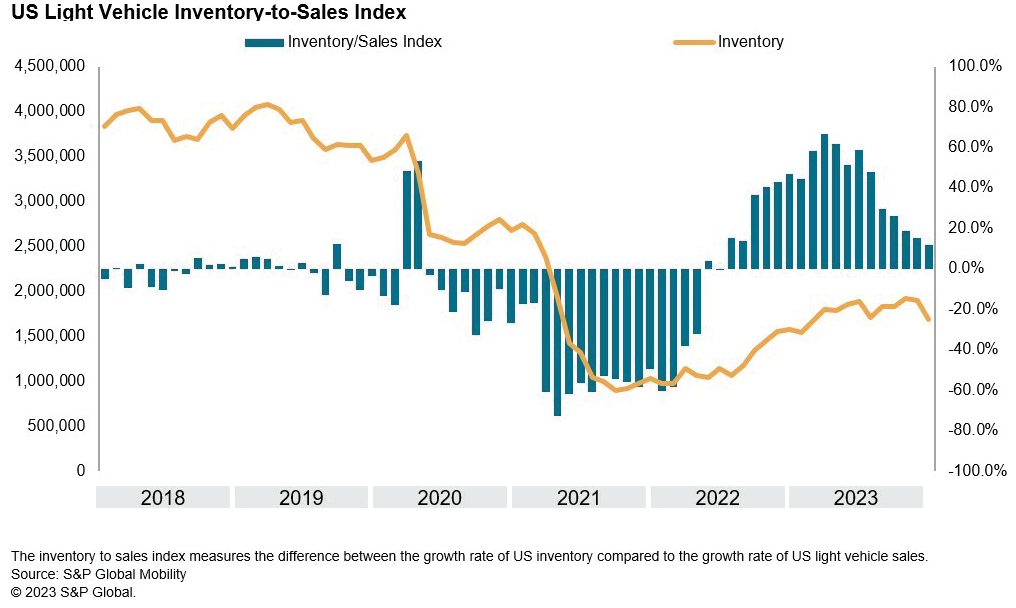

Throughout 2021-2022 there were a number of issues that dogged automakers as the plants returned to full production. From the sales side, inventory couldn’t keep pace with the surge in demand. Part shortages, especially microchip shortages, hamstrung auto production, leading to long lead times for deliveries, while other supply chain disruptions exacerbated the dealers’ inventory calamity. This combination led to higher auto prices, “In 2022, supply constraints have led to long lead times for new vehicles, and in the process ensured that transaction prices are well above historical norms,” as MarkLine, an auto industry portal wrote describing last year’s conditions.

The microchip shortage was particularly damaging. To handle the chip (and parts) shortage, GM pioneered a strategy tagged “build-shy” or “shy-built” which involved assembling some of its vehicles – generally the lower priced models – “just shy” of all its parts. So, rather than delivering “complete” vehicles to the dealerships, the unfinished models were set aside in nearby lots…awaiting parts. In some cases, the “parts-shy” vehicles were sold to consumers and the “missing” parts fitted later at the dealership.

However, the chip shortage has eased, and the acres of vehicles are now moving off the storage lots to dealers and customers.

While supply chain disruptions and part shortages have lessened, other aspects of the fourth quarter of 2022 have spilled into the new year. For example, J.D. Power & Associates expects the average new vehicle price for the month of January 2023 to be $46,437 an increase of 4.2% over January 2022, although the consultant believes the average transaction price will moderate as more inventory hits car dealers’ lots.

Other contradictory factors could also impact auto sales. On the one hand, inflation, higher gas prices, a strong US dollar and a potential recession certainly are factors, while low unemployment figures and new jobs act as an economic counterbalance – elements of “Shrinkflation” as the contradictory economic indicators are popularly tagged.

In January 2023, The Consumer Confidence Index (CCI) fell to 107.1 [1985=100] from 109.0 in December. Ataman Ozyildirim, Senior Director, Economics at The Conference Board that produces the CCI wrote in the January survey, “Consumers were less upbeat about the short-term outlook for jobs. They also expect business conditions to worsen in the near term. Despite that, consumers expect their incomes to remain relatively stable in the months ahead. Meanwhile, purchasing plans for autos and appliances held steady, but fewer consumers are planning to buy a home—new or existing.”

Cox Automotive, a company that specializes in reporting on the auto industry, in their January forecast [updated in February], wrote, “Our forecast called for a sales pace of 15.6 million [note: units sold during the year expressed as a monthly “pace”], and indications are the market came in slightly higher, closer to 15.7 million. Either way, new-vehicle sales in January were solid and likely a sign that improved inventory levels are having the expected positive effect. We [Cox Automotive] also believe that fleet sales increased significantly for the fourth straight month. With interest rates for auto loans elevated and heading higher and inflation pressures impacting many households, our team expects the major automakers to pivot to fleet sales to offset slowing retail demand.”

When Cox says “fleet” sales it refers to a market composed of rental companies and other corporate entities that buy fleets of vehicles for either their own use or lease, rather than consumers that make up the retail side of the business.

The National Automobile Dealers Association (NADA) takes a similar view of the forces shaping the auto market, but overall has a less rosy view of 2023, largely based on rising interest rates, “The Fed increased the targeted range of the Fed Funds Rate by 25 basis points at its first meeting of 2023. This increase will push vehicle-financing rates higher in coming months, and we [NADA] believe that the Fed will increase rates a couple more times before pausing later this year. For the rest of the year, we expect that inventory levels will continue to build slowly, giving consumers more choice on dealer lots. With fewer supply constraints, OEMs should also be able to deliver more vehicles to fleet customers. Our forecast for new light-vehicle sales in 2023 is 14.6 million units [Editor’s Italics].”

Bottom line is whether it is a 15.7 million unit pace or 14.6 million unit pace, auto sales clip, is far short of the 17 million unit pace of pre-pandemic auto sales.

Is this the new ‘normal’ or a springboard to a more robust auto market over the next decade? Right now, it’s hard to determine which way the wheels are spinning but there are some clues.

Breaking the ICE – EVs Gaining Ground

According to NADA’s numbers (derived from Wards) 86.4% of the light vehicles sold were powered by internal combustion engines (ICE). That’s an overwhelming market share but electric vehicles (EVs) are gaining ground and becoming a major and rising contributor to auto sales. On a percentage basis EVs are the fastest growing segment of the auto industry, albeit starting from a much lower base point. Data, from Statista estimates that EV sales will hit $450 billion in 2023 and expect that number to rise to $850 billion by 2027 - a mere four years from now. It’s easy to see with these projections how EV sales might lift auto sales back to the pre-pandemic threshold.

Of course, at this stage the EV market is fragmented and small in relation to ICE sales. In 2022, pure electric vehicles also called battery electric vehicles or BEVs, accounted for 6.4% of sales, while hybrids hit 5.7% and plug-in-hybrids 1.4% of sales. While there is a wider public interest in EVs with the rise in environmental, social and governance (ESG) initiatives – especially in states like California – the main barrier is price. For most consumers that means EV price and ownership parity with ICE vehicles. Right now, EVs are pricier, whether measured by sticker price or ownership operating costs. But that may be changing. Tesla and Ford are reducing the prices of their EVs to encourage consumers to go-electric now.

But other EV OEMs, like GM are for the moment content to sit on the sidelines of the EV price-war and wait for the auto market [and the global economy in general] to rally.

That might not be a wise strategy. John McElroy, president of Blue Sky Productions which produces Autoline Daily, recently wrote an opinion piece for WardsAuto, that pointed out the potential danger of OEMs sitting on the sidelines during the coming EV wars, “This is not a time for automakers to wait and see how things develop. It’s going to be very difficult for those who arrive late to catch up. There is a finite universe of BEV buyers right now, and whoever gets them first will leave everyone else struggling to find customers.”