“No fruit dies so vile and offensive a death as the banana…” Kiran Desai, Indian author

In a strange coincidence with the Covid-19 pandemic, the banana is facing its own pandemic – the disease, Tropical Race 4 (TR4), which like COVID-19 has no known cure and is racing across the globe laying waste to banana plantations and threatening the banana’s very survival.

There is no business quite like the ubiquitous banana. According to a recent report by the FAO (Food and Agricultural Organization of the United Nations) approximately 20.2 million tonnes of the yellow fruit were exported internationally in 2019, making it the world’s largest “fruit” or vegetable traded.

The banana, which notched an estimated $14.7 billion globally in 2019, has been the “top banana” of the global perishable trades for over a century and has faced few challengers – (although avocado sales have grown rapidly and is now globally a $6.5 billion business) but the spread of TR4, climate change and other socio-economic factors dim an otherwise bright future for banana exporters.

Global Appeal and Rise of the Cavendish

According to the FAO [Banana Market Review – February 2020] the estimates for the global production of bananas for the 2017-2019 period was about 116 million tonnes worth $31 billion – a substantial increase over the 2000-2002 estimate of 69 million tons. The principal impetus for this rapid growth in banana production is two-fold, rising populations in banana producing nations and rising demand in consuming nations. Naturally, given these two trends, the greatest increases in production have come in nations that are both top producers and consumers of bananas.

Although never thought of as big banana producers both India and China (and to a lesser extent Brazil) are top producers of bananas but consume a large portion of their production and in the instance of China are even compelled to import bananas to the tune of over $1 billion in 2019 - and rising.

For example, India, the world’s largest banana producer (as well as mangoes), grows around 29 million tons annually, while China the number two producer accounts for around 11.7 million tons of produce annually. But as is the case with many smaller producing nations, both of these giants report only negligible banana exports. Although both China and India have added significant acreage to their banana cultivation – effectively doubling the acreage in the period from 2000-2018.

Of course, the reality is global production figures for bananas is more a guesstimate than hard agribusiness numbers. Banana cultivation is largely in the hands of small farms and the trade is often little more than village markets. There are well over a thousand varieties of bananas but most are used in non-commercial activities. The FAO estimates that 70%-80% of production in Africa is local bananas largely used for cooking.

The commercial banana yields per hectare vary widely, influenced by banana variety, climate and agricultural inputs such as fertilizers and pesticides, ranging from 30-60 tonnes per hectare.

Extinction Event: Threat of TR4

A vast majority of the plantation crop is the Cavendish banana, but that wasn’t always the case. The banana that started the banana boom in the 1870s in the United States and Europe was Gros Michel – nicknamed the Big Mike. The Gros Michel arrived on the breakfast tables of the U.S. through circuitous circumstances beginning in Southeast Asia with stops in Martinique and Jamaica before becoming a plantation staple in Honduras, Costa Rica and South and Central America. The “Big Mike” was the fruit of legend as it launched the Great White Fleet and was variety put to song, “Yes we have no bananas, we have no bananas today” in the 1920s. Unfortunately, the lyrics proved prescience as in the 1950s the Panama disease (first reported in Australia in 1876), a wilt caused by a fungus (fusarium oxysporum f.sp. cubense) wiped out vast tracts of Gros Michel plantations in Central America – pushing the variety to commercial extinction and growers began looking for a substitute.

The Cavendish banana was the commercial solution and replaced the Gros Michel as the banana of choice for export in the 1960s. It now is virtually the only banana variety carried in the big supermarkets that are responsible for most consumer sales. And the Cavendish makes commercial sense, as it has a high yield per acre, short growth period – nine months - and a natural resilience to the bumps and bruises inherent to shipping over long distances.

But history may be repeating itself with the spread of Tropical Race 4 (TR4) of the Fusarium wilt fungus that has been affecting banana production in Asia.

TR4 is a soil pathogen that attacks the roots of the banana plant and blocks its vascular system. The damage first shows in the leaves, which turn yellow from their trailing edges before wilting away.

According to FAO reports TR4 was first found in Taiwan, and has subsequently moved from Southeast Asia – Indonesia, Malaysia and the Philippines reporting cases in the 1990s – to China, India, the Middle East and Africa and is now threatening Latin American banana plantations. With no cure for TR4, the only solution growers have is to abandon diseased sites and isolate their cultivation – ironically like the Covid-19 situation – to prevent further spread of the contagion.

The Business of Bananas

It’s no surprise that Latin America (excluding Mexico) plus the Caribbean accounted for the boatload of banana exports in 2019, valued at an estimated $8.3 billion or about 57% of global sales. European exporters, largely former colonies in the ACP (African-Caribbean-Pacific) accounted for 17.5% with Asian exporters tallying 15.6% and Africa 5.2%.

The U.S. and EU engaged in a 15-year “Banana War” over the EU’s policy of favoring the ACP exports over those of Latin America – largely backed by U.S. companies (see box). Under the banana stabilization policy, the EU could suspend preferential treatment should a banana exporting nation exceed its “quota” or threshold and/or destabilize the EU banana market. However, in June of 2019 the Commission decided against deploying the “stabilization” protocol on Nicaragua sales even though the country exceeded the “threshold” on banana imports to Europe in March, which was 14,500 tons for the entire year. The Commission’s logic was the imports didn’t have a deleterious impact on the European banana market, despite the fact that banana rates had fallen and imports had increased.

While the disagreement over Latin American banana imports has taken a backseat to more pressing issues such as BREXIT, COVID-19 and tariff wars, the split over bananas still lingers.

Over the past decade the shape of the banana market has changed and could well change again in a post COVID-19 global economy. Russia and China have become importers ranked #2 and #4 respectively and many believe China will overtake Russia this year, particularly should the domestic production falter (see chart). Both Belgium and the Netherlands ranked #3 and #5 [although some statistics show the edging out of Belgium] act as distribution centers for European consumers, including the UK which imports over $745 million worth of bananas annually. At this stage, how BREXIT will impact the banana supply chain is anybody’s guess but more direct shipments from producers to the UK could well be in the cards.

Banana Exports and Ecuador

Ecuador is a small exporter by international trade standards, but is the king of banana exports. In 2019 the country exported $3.3 billion in banana exports, roughly 22% of the global total. In some cases, like Russia where Ecuador accounts for 96% of the total banana imports – it is a near monopolistic exporter. But there are a number of threats facing Ecuador’s money crop – in November of 2019 Russian agricultural officials warned that it might restrict the import of plant products from Ecuador, including bananas. The department made this statement after polyphagous humpback fly was found in imported products. On December 12, the Russia said that the inspection had found the dangerous insect in Ecuadorian bananas again, threatening imports. But the largest threat facing Ecuador is TR4 which for the moment hasn’t significantly hurt the 8,000 producers in the country.

The Philippines, which eclipsed Colombia, is now the number two exporter of bananas at just under $2 billion in sales or about 13% of the market. By far the number one exporter in Asia, the Philippines has a natural advantage with proximity to major markets – China and India – that Central American producers do not share. All things being equal, the Philippines could challenge Ecuador for the number one exporter position within two decades but TR4 represents a real threat to Philippine aspirations.

Other Central American nations like Colombia ($1.6 billion 11% share), Costa Rica ($1 billion 6.4%) Guatemala ($944.5 million 6.8% share) and Panama ($380 million 2.6%) expect to see their exports increase over the next decade but as with all the major producers the threat of TR4 looms over any projections.

Bananas by the Numbers

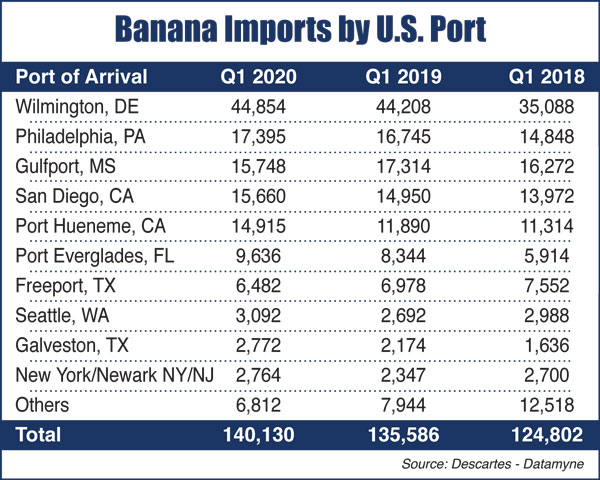

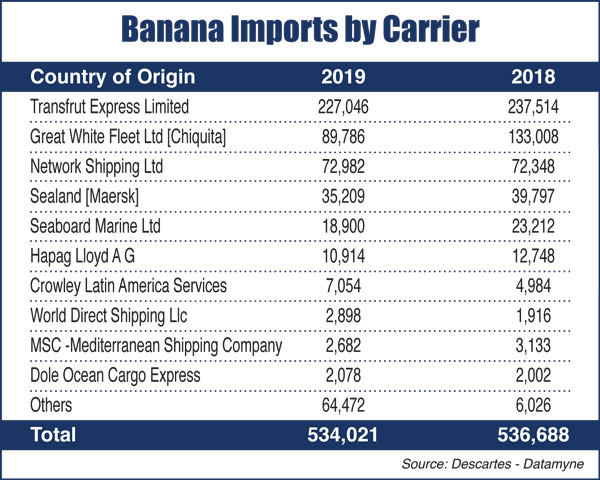

In the U.S. the Port of Wilmington, Delaware is by far #1 in the handling of imported bananas. In 2019 the Port handled over 170,000 TEUs of bananas according to data collected by Descartes-Datamyne (see charts). For comparison, Philadelphia and Gulfport, Mississippi both handled over 65,000 TEUs ranking a distant #2 and #3 in banana imports.

The impact of the COVID-19 pandemic has thus far been negligible as the 2020 1st quarter statistics for most ports are either up or just slightly off the 2019 1st quarter numbers.

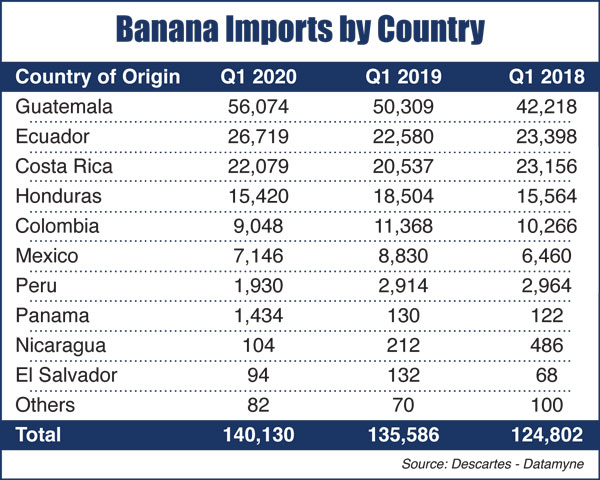

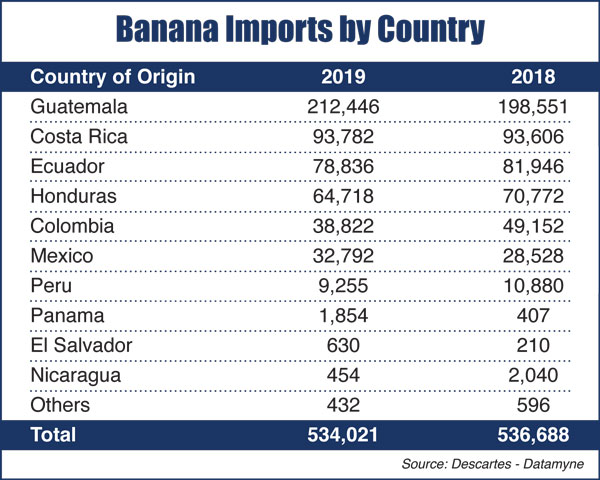

The statistics are also true for the banana exports from the Central American exporters. For example, Guatemala’s 2019 numbers (212,446 TEUs) were up over 2019 (198,551). And in the first quarter of 2020 Guatemala’s numbers were up (56,074 TEUS) over the first quarter of 2019 (50,309 TEUs). The trend was true for other major suppliers like Ecuador and Costa Rica while Honduras, Colombia and Mexico were slightly down. Overall, banana imports were up 140,130 TEUs in QTR 1 2020 to 135,586 TEUs in 2019 QTR1, despite the COVID-19 impact on the U.S. economy.

The business of bananas looks strong even in a recession. Still the question is will banana exports wilt if TR4 begins to have a major impact on the Central American plantations and as Desai said, nothing is as offensive as the death of banana…plantations.