But a downturn may represent a turning point

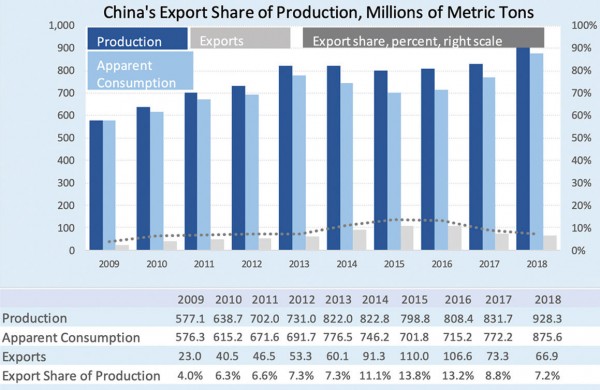

The steel industry in China has been blamed for much of the woes faced by the sector globally in recent years. Overcapacity and overproduction in the People’s Republic of China (PRC) have led to dumping steel in international markets, thereby suppressing prices and eating into the profits of companies in advanced economies.

“China’s supply reform and stricter environmental policy have worked positively in the market,” said Eun Young Lee, a steel industry analyst at DBS Bank in Singapore, “but Chinese stimulus policy is the wild card for steel demand.”

Chinese Consolidation

The Chinese government has promoted industry consolidation by removing outdated and small players and concentrating on large-scale mills through mergers and acquisitions. Its so-called “blue sky action plan” directly restricts utilization of steel production capacity and indirectly increases production costs by regulating sintering and coking plants.

In the first half of 2018, Chinese steel demand received a boost from a mini-stimulus package for the real estate industry. The government is considering further stimulus policies to mitigate the harm being done by the trade dispute with the United States. “China steel demand growth is expected to decelerate in the absence of stimulus measures,” said Al Remeithi, chairman of the World Steel Association (WSA) economics committee. Continued economic reforms and toughening environmental regulations “will lead to deceleration of steel demand into 2019.”

But both downside and upside risks exist for China. “Downside risks come from the ongoing trade friction with the U.S. and a decelerating global economy,” he added. “However, if the Chinese government decides to use stimulus measures to contain a potential slowdown, steel demand in 2019 will be boosted.”

The expansionary measures the Chinese government is considering include reducing import tariffs and accelerating the implementation of infrastructure projects. Planned infrastructure projects include one-thousand miles of subway lines in Shenzhen, Suzhou, and Changchun, which would generate 80 million tons of steel demand.

China’s supply-side reform has introduced “fundamental improvement in the global steel sector,” according to Lee. China began the reforms in 2016, with the target of removing 100 million to 150 million tons of steel capacity and 800 million tons of outdated coal capacity by 2020. By 2017, 115 million tons of steel capacity had already been removed through consolidation along with as much as 120 million tons of substandard steel capacity.

“World steelmaking capacity is down from its 2015 peak by 3.5 percent over two years,” said Lee. Global capacity totaled 2.25 billion tons in 2017, down from 2.33 billion tons in 2015. “China continues to work towards industry consolidation,” Lee added.

China’s industry-consolidation program is operating off the 13th Five-Year Plan, which calls for raising the concentration ratio among the top-10 industry players from 34% in 2015 to 60% in 2020. Baowu, China’s number-one steel player formed from a merger between Baoshan and Wuhan steel in 2016, was reportedly in talks with Magang Group over a possible merger, although some have denied those reports. If successful, the combination will create China’s new top steel company with 2017 production of 85.1 million tons representing 88% of the world’s biggest steel producer, ArcelorMittal, which produced 97 million tons that same year.

The Chinese government’s policies of limiting industrial activities may be moving in the opposite direction with the adoption of a more flexible approach for emissions this winter. The Chinese government did not repeat last year’s across-the-board cuts but allowed local governments to decide on their own measures to meet emission targets during the heating season. The government also reduced its target for the number of days of severe air pollution in northern cities from 15% last year to five percent in this year’s initial plan to three percent in its final plan.

The municipalities implemented a variety of schemes, some of which did not hew to the central government’s percentage reduction goals. It’s unclear at this point how effective these local measures will prove to be nor their ultimate effect on steel production within the larger picture of capacity reductions.

Steel traders assumed that the situation will not play out as effectively as the government’s stricter approach last year, and steel prices dropped as a result. “Implementation of a more flexible-smog policy rather than a one-size-fits-all fight on pollution weakened sentiments,” noted Lee. In other words, traders calculated that steel production and supply would grow as a result of the government’s more lenient environmental policy.

China Steel Production Still High

Despite continued supply reform policies, China’s steel production remained at a record high, at least as of the end of 2018, with output on target to register growth of well over eight percent for last year. There is also evidence, according to Lee, that some illegal capacity continues to operate, although the government is cracking down on that phenomenon.

Steel producers also upped their production late last year in advance of the winter regulations, creating a supply surplus and precipitating a dip in prices. “We expect the supply surplus to be temporary as steel production in China will be negatively hit even under the revised winter production cuts,” said Lee.

Lee expects global production growth to slow with China’s output shrinking beginning this year. “China’s production is set to post negative growth in 2019,” said Lee, leading to a deceleration in global steel production growth from 3.5 percent in 2018 to 1.0 percent to 1.3 percent in 2019.

“China’s supply reform and environmental regulations,” Lee concluded, “will remain as key determinants to global output.”