Economists are looking at whether there will be a freight recession and/or economic recession but indicators for each are moving in opposite directions.

Whether a recession is coming to the United States economy and whether the U.S. market for truckload services is similarly distressed are two separate questions that are not directly related to one another. According to the Coyote Curve, a forecasting model developed by Coyote Logistics, the current downward spiral in truckload rates will be followed by an inflationary surge in early 2020—whether or not a recession comes to the US economy.

Meanwhile, another group of analysts, also looking at shipment information but from a different perspective, find that the current freight data suggests that a recession is coming to the US economy. In fact, says Cass Information Systems, the recession may have already begun. (See sidebar on page 16.)

The U.S. truckload market moves according to the inflationary and deflationary cycles characteristic of capitalistic economies but not necessarily in tandem with the economy as a whole. Last year’s truckload market broke records in terms of volumes and rates and was followed by this year’s record lows. But the Coyote Curve projects a heating up of the spot and contract truckload markets for this year’s peak holiday season and into 2020.

“The 2017 and 2018 market caused a lot of pain for many truckload shippers as rates jumped to historic highs,” said Pickett. “We believe 2020 has the potential to create very similar challenges for shippers.”

U.S. truckload is hardly monolithic and is notoriously difficult to characterize, with many thousands of shippers and carriers participating in the $700-billion annual market. On the carrier side, small market participants exploit low barriers to enter an industry that refuses to consolidate. On the demand side, hundreds of thousands of manufacturers, retailers, and others need truckload transportation, each with their own objectives, constraints, and needs.

The Coyote Curve captures a myriad of data to create indexes that can be used to predict future trends. So, for example, its Spot Market Index dropped precipitously during the first two quarters of 2019, but at a lesser rate during the second quarter. This indicates that the “rate of deflation in the second quarter eased” and suggests “that the market is at an inflection point,” said Pickett. “Demand is starting to increase again and will drive rising spot market rates heading into” the fourth quarter.

The last part of any year is always characterized by increased shipments for the holiday shopping season, and the Coyote Curve indicates that during the peak season of this year, the market will be moving toward equilibrium as it comes off the deflationary trend. Moving forward, the Coyote Curve points to “more demand relative to supply,” said Pickett, because carriers have been removing capacity in response to 2019’s deflation, allowing rates to increase, perhaps during the first or second quarter of 2020.

“Inflationary environments tend to pull new capacity into the marketplace until too much comes in and puts a ceiling on rates,” Pickett explained. “Many carriers may have overshot their truck orders and plans based on the previous year’s more favorable economic conditions. That creates a rate trough like we’re in right now.”

The Cass Shipments Index was negative for the first time in 24 months in December 2018, and has followed with negative numbers through July, which saw a 5.9% drop. This prompted the company to be more forceful in describing the index from “warning of a potential slowdown” to “signaling an economic contraction,” in other words, the beginnings of a recession.

Coyote does not dismiss the possibility of a recession but contends that the U.S. truckload market will already be in rebound mode in terms of rates by the time a recession appears. Pickett contends that the end of the second quarter was the low point for the U.S. truckload market, and that the market will move toward equilibrium for two or three quarters before moving toward an inflationary mode.

Coyote is not predicting a recession, but Pickett allowed that there are “danger signs flashing around the world.” If negative GDP growth does come about, it could stunt the level of freight rate inflation in 2020, but it won’t reverse the overall trend because of the truckload capacity that exited the market in response to 2019’s deflation.

“We can still expect an inflationary market in 2020 even if there is a recession,” said Pickett. Other wild cards that could impact the trend would be one or more major weather events and trends in the price of fuel.

Pickett foresees the same trend with contract rates, perhaps on a slightly different timetable. “Contract rates are likely to fade into negative territory year-over-year in the fourth quarter of 2019 as spot rates head toward equilibrium,” he said.

The lesson for shippers is that the cost savings they experienced in 2019 will likely be short lived. “They should start thinking about how this will impact their supply chains,” Pickett said.

For carriers, “financial stability became a growing concern” during 2019, “as rates became lower but not costs,” said Pickett. “This duress will cause more carriers to exit the market and more mergers and acquisitions activity to consolidate excess supply as we close out the year.”

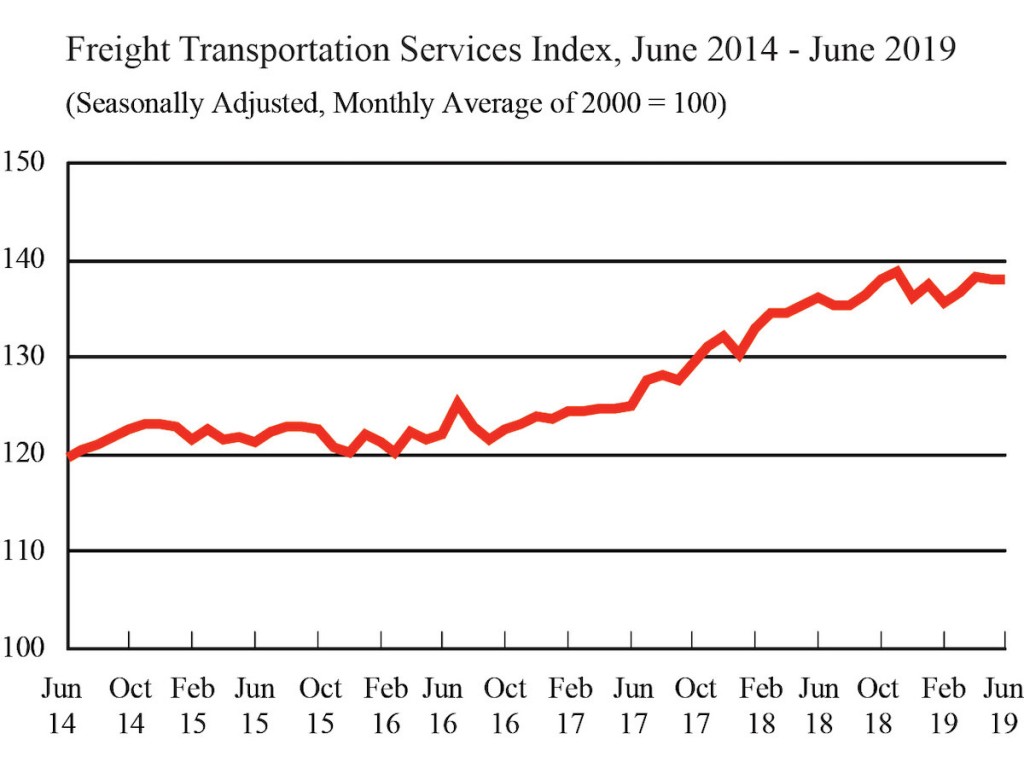

Whatever the immediate future holds, the American Trucking Associations maintains a rosy outlook for the future of U.S. trucking in the longer term. The picture also looks positive for intermodal rail, air, and domestic waterborne transportation, according to ATA. Numbers released in late August showed continued growth in the industry, with projections of a 25.6% increase in tonnage by 2030 to 20.6 billion tons and freight and logistics revenues increasing by 53.8% to top $1.6 trillion annually during the decade.