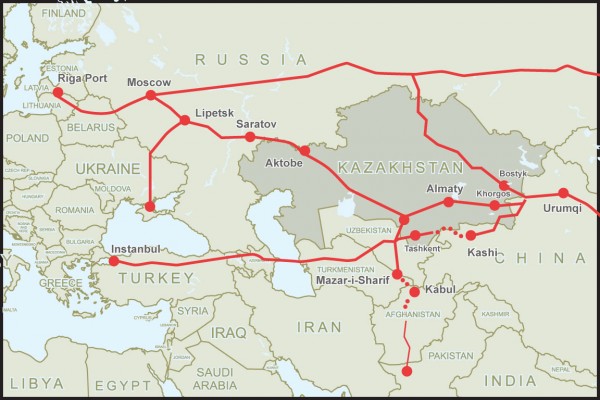

Building on its strategic location, the landlocked Central Asian nation of Kazakhstan is hoping to become a transit cargo hub between China and Europe – and further extend its reach to North America – and thus also boost its cargo traffic, including the breakbulk segment.

Kazakhstan’s burgeoning cargo traffic is linked with China’s ambitious Belt-Road-Initiative which has cast a wide net extending to over 60 countries.

Currently, China is evaluating several transportation modes to Southern Europe. In addition to the Transport Corridor Europe Caucasus Europe (TRACECA) and the Russian southern route, another option may involve the use of the Baku-Tbillisi-Kars railway line – an 826 km (513 miles) route that bypasses Russia, and eliminates the Black Sea transshipment. The TRACECA will also help boost breakbulk shipments through Kazakhstan. The Trans-Siberian Railway is another option to increase cargo traffic.

While Kazakhstan has become a vital link in the overall supply chain connecting China and Europe – with the potential to further develop to North America – the breakbulk cargo segment is also increasing: while cargo shipments, until the recent past, comprised of oil and gas, agricultural products, chemicals, etc., there are also growing volumes of hardware products, computers, electronic and electrical parts, cars, etc. being shipped today.

DP World Interests

Meanwhile, Dubai based DP World has also intensified its ties with Kazakhstan. DP World has signed a slew of agreements with Kazakhstan, including two new framework agreements relating to the acquisition, governance and managements of special export zones at the ports of Aktau (Kazakhstan) and Khorgos (China). This has led to an increase in traffic in various cargo segments, including breakbulk.

In a recent interview with the American Journal of Transportation at the New York based Council on Foreign Relations, which hosted a special session on Kazakhstan called “Kazakhstan in a Changing World”, Arystan K. Kabikenov, the vice minister in Kazakhstan’s Ministry for Investments & Development, pointed out Kazakhstan was keen to have international companies set up operations in his country, which would lead to robust trade not only between Asia and Europe but also to North America.

“I must point out that Kazakhstan, a country rich in minerals and natural resources, has established a chemical zone where foreign companies can set up manufacturing operations. We are keen to diversify our trade and shipping, and also build up our breakbulk traffic,” he noted, adding that hi-tech as well as electronic and electrical goods’ production would help strengthen his country’s economy.

Promising Transit Hub

Kazakhstan, which emerged as one of the Commonwealth of Independent States (CIS) after the collapse of the former Soviet Union and is the region’s second strongest economy, is seen by Asian experts as a “very promising transit hub” for the China/EU traffic, with its strategic location playing a crucial role in future trade flows between Europe and Asia.

According to Kazakh Invest, the country’s investment promotion agency, Kazakhstan attracted in 2017 a total foreign direct investment (FDI) volume of US$ 21 billion; the cumulative FDI, from 2005 to 2017, amounted to US$ 264 billion.

Kazakhstan’s total global trade amounted US$ 78.1 billion in 2017, with exports accounting for US$ 48.5 billion and imports US$ 29.6 billion.

Saparbek Tuyakbayev, Kazakh Invest’s CEO, told American Journal of Transportation that the Kazakh government had put a new five-year strategy in place to attract investments. “We are experiencing a second wave of investments,” he said. Kazakhstan has also undertaken a slew of initiatives aimed at improving the country’s investment climate. Tuyakbayev pointed out that the World Bank this year ranked Kazakhstan at 36th position in the “Ease-of-Doing Business” ranking.

Kazakhstan believes that the Belt-Road-Initiative – the “New Silk Road” Initiative, as some call it – will give it a unique opportunity to emerge as a key Asia-Europe transportation hub. An ambitious road project stretching some 8,445 km and connecting Western China and Western Europe through Kazakhstan and the CIS, Eastern Europe, South Asia and the Middle East is being projected as a game-changer that would make Kazakhstan the “hub of choice”. This would also boost the breakbulk traffic and enable Kazakhstan to realize its goal of becoming by 2020 the key cargo hub in Eurasia and beyond by developing transportation and export centers on its territory. Kazakhstan’s Western Europe-Western China International Transportation Corridor is expected to reduce transportation time from 30 to 10 days while increasing the transit cargo volume to 170 million tons, up from the current 16 million tons, and considerably strengthening the economy.

Kazakhstan’s transport infrastructure stands to benefit from huge allocations: some $27 billion is being spent on building new roads and highways, port construction, investment in the aviation industry, and development of rail freight.

Kazakhstan Railways (KTZ) recently opened the Khorgos Gateway, the world’s biggest dry port, on the border with China. This $357 million logistics hub is aimed at getting a large chunk of Chinese cargo being shipped across Asia into Europe. Even so, Khorgos Gateway is only a small slice of KTZ’s planned total $36.3 billion investment for improving connectivity with China over the next five years.

One train service, linking the southwestern Chinese city of Chongqing with Germany’s Duisburg, already runs regularly, reducing delivery time by up to two-thirds compared with maritime shipping. Rail transportation can be cost-effective – rail shipments are more expensive than sea shipments – if time-critical or high-value products are being shipped. The Chongqing-Duisburg train, for example, has delivered Acer and Asus computers to Europe and Mercedes and BMW cars to China.

However, to become a major transit cargo hub between China and Europe and get a slice of the $600 billion cargo pie, Kazakhstan will need to cut down its red tape which results in complex and often time-wasting processing that can be a slowing factor in its cross-border trade traffic.