If this year’s Black Friday sales were a precursor to what 2023 will bring us, the all-time record sales of over $ 9 billion would indicate the economy is hitting on all cylinders. While consumers may have their heads in the sand, most economists are sticking with their prediction of a recession in 2023. Many would argue that we are already in one. Higher interest rates, falling home prices, declining corporate earnings are just some of the signs we are on the verge of one. Adding to that is a dramatic trend in corporate layoffs particularly in the technology sector.

The current mood amongst the container carriers has gone from ebullient to grim all within the same year. While no one expected container rates to remain at stratospheric levels, not many expected to be hearing predictions of rate wars and seeing the spot rate collapse in a few short months. Blank sailings have once again replaced long wait times at LA/Long Beach. The tricky part moving forward is the container carrier’s ability to manage capacity with freight demand in order to remain profitable. In the meantime, pent up demand for imports is slowing and allowing excess inventories to be worked off. It will be interesting to see just how 2023 takes shape with the US consumer. More of a family’s disposable income may be redirected as a result of higher food prices and energy related expenses.

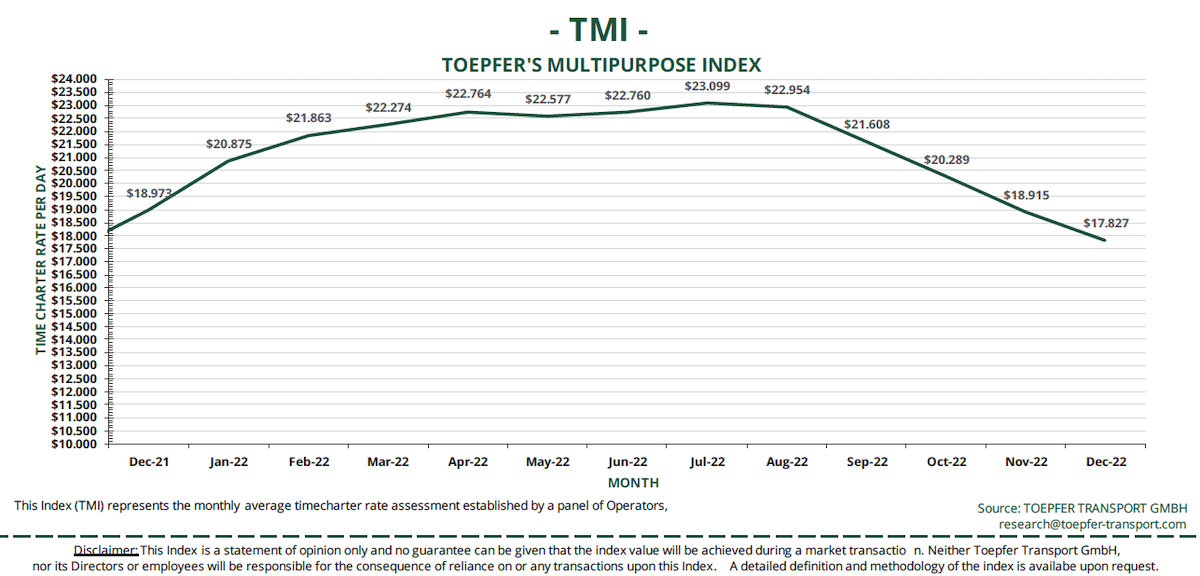

Multi-Purpose Vessels Sector Correction

The MPV/HL sector has recently begun a correction of its own albeit much milder than the container sector has experienced. Based on Toepfers Multipurpose Index (TMI) for November 2022 has fallen below the $20,000 mark for the first time in 10 months. This correction was not unexpected and in fact could provide incentive for owners to consider additional newbuild investments and fleet replacement. The global MPV fleet has continued to age and is now in dire need of replacement tonnage. New IMO regulations coming into effect in 2023 will cull out older tonnage that is unable to comply with the new regulations. It is forecast that the MPV sector will experience a shortage of tonnage to support freight demand in the next few years. This scenario is not likely to change anytime soon as newbuilding activity is expected to remain at modest levels through 2023.

IMO and MPV Sector Challenges

Many owners and operators in the sector still have concerns about inflationary pressures, rising interest rates, the war in Ukraine and China’s continued struggles with COVID and its zero tolerance policy. These all could result in some form of global recession next year. However, freight demand in the project sector is forecast to be strong in the coming year. The energy sector remains the foundation of the MPV sector with wind, oil and gas segments all expected to perform well in the coming year. This, along with the tight supply of tonnage should keep rate levels in a profitable range. One energy source we don’t hear much about in the mainstream news is nuclear power. According to the World Nuclear Association there are currently 100 new plants scheduled for construction globally over the next five years. The majority of these plants will be located in China and Eastern Europe. The U.S. only has 2 plants currently under construction, Vogtl #3 and #4 which were scheduled to start operating in 2016 and are now only scheduled to open next year at a cost overrun of double the original construction estimate.

What the MPV/HL is unable to forecast is the true impact that further regulatory actions on the part of the IMO will have on the sector. Starting in 2023 there will be two new metrics introduced requiring owners to measure a vessel’s overall energy efficiency and actual carbon dioxide emissions. This will result in some vessel owners needing to make modifications to their vessels in order to meet the new standards. In all likelihood, some owners will find it more prudent to scrap the vessel than to bring the vessel into compliance.

The financing community is already focused on carbon emissions of a vessel being financed. As the EEXI (Energy Efficiency Existing Shipping Index) and the CII (Carbon Intensity Indicator) requirements come into effect, there will be a renewed focus by lenders on how financing is structured moving forward. The true impact to the current MPV/HL fleet will not be known until we see how many vessels are willing and/or able to comply with these new standards.