It’s a phenomenon that’s sweeping the nation, from coast to coast

In August, the Port of Virginia reached an agreement to lease 72 acres of the 287-acre Portsmouth Marine Terminal to Dominion Energy for the staging and pre-assembly of components for the 2,600-megawatt Coastal Virginia Offshore Wind farm. Virginia has a legislative target to generate 5,200 megawatts of offshore wind energy by 2034, to be supplied in part by the Dominion Energy project, located 27 miles off the coast of Virginia Beach.

The connection between offshore wind energy and local port development has been evident for some time. The United States lags behind Europe in the development of wind energy and its infrastructures, but that has provided policymakers on this side of the Atlantic an example from afar on how the offshore industry can stimulate economic development and create jobs in their comunities.

Benefits of Wind: Grimbsy, England

The town of Grimsby, England, is one case of a community that has benefitted from the development of a port facility to support offshore wind. Grimsby was once a struggling fishing village, but that changed when an offshore wind port brought a supply chain of manufacturers, suppliers, support vessels, and services to the town. Within a few years, Grimsby saw significant economic growth thanks to the offshore wind industry.

In 2019, the Danish offshore wind developer Ørsted, a key player in the New Jersey wind story, opened an expanded operations and maintenance (O&M) hub in the port of Grimsby, where offshore-related activities had been ongoing since 2010, after investing $12.3 million at the Grimsby Royal Dock and surrounding areas. The hub, which employs over 350 workers, serves as an O&M base for five of Ørsted’s operational wind parks in British waters, and a sixth to become operational in 2022. A report from the think tank Green Alliance found that hundreds of jobs and tens of millions of dollars in investments flowed into Grimsby even before Ørsted’s 2019 expansion.

The offshore wind industry “is creating high-value jobs and helping to offset the long-term decline of employment in other local industries like fishing,” said Matthew Spencer, director of Green Alliance.

The offshore wind industry in Grimsby brought “a range of economic benefits to the town,” the Green Alliance report found, including the prospect of stable, long-term jobs. “A typical offshore wind farm has an operating life of 25 years,” the report said, “meaning the operations and maintenance of existing North Sea wind farms will provide jobs in Grimsby for at least a generation.”

In the U.S., the first commercial offshore wind farm, three miles off Block Island, Rhode Island, which opened for operation in 2016, also provided a boon to local ports. The original 30-megawatt project led to Rhode Island’s approval of a larger 400-megawatt facility further out to sea, and a consideration of how logistics assets should be deployed in support of that and other offshore projects. Forty-million dollars in investments soon flowed to the Port of Providence and other Rhode Island facilities, including the port of Davisville, where expansion is ongoing to expand berthing space to accommodate wind energy projects.

Energy Policy

Critical to Grimsby’s success, according to Green Alliance, was a “stable national energy policy.” In the U.S., development of the offshore wind industry has been largely being driven by the states, but the Biden administration’s commitment to developing 30 gigawatts of offshore wind energy nationally could alter that picture, and bode well for economic development in wind port communities. With the prospects of national policies and funding being put into place, communities on this side of the Atlantic are vying to emulate Grimsby by grabbing a piece of the lucrative offshore wind supply chain.

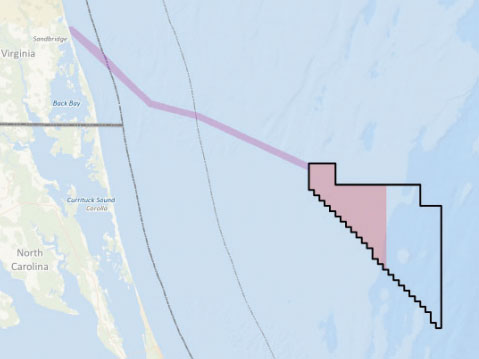

North Carolina is now studying how it can put its logistics assets to use for the wind industry. The Kitty Hawk Offshore project, to be located 27 miles off North Carolina’s Outer Banks, recently passed a first federal permitting milestone for an 800-megawatt project to begin operations in 2024.

A North Carolina Department of Commerce report released earlier this year recommended assessing “the competitiveness of an installation port along the southern North Carolina coast, as one input to the location of future lease areas off the coast.” The possibility of using facilities at the ports of Wilmington and Morehead City for wind-energy projects, the report noted, would “allow North Carolina earlier access to supply offshore wind projects.” The department also urged an evaluation of the 600-acre Southport/North Carolina International Terminal Property, which it described as “a one-of-a-kind opportunity to be developed into an OSW [offshore wind] mega-port facility.”

Other North Carolina assets under consideration include Radio Island, adjacent to the Port of Morehead City, an undeveloped location near a deep-water channel and intermodal connections. The Wilmington Business Park, which could be used for manufacturing and staging of components, is “already developed to support heavy manufacturing activities,” the report noted.

While much offshore wind energy activity is being focused off the east coast, the west is not being left out of the process. In July, the Bureau of Ocean Energy Management designated a 206 square-mile area off northern California for the Humboldt Wind Energy Area and will be conducting a lease auction for a site 20 miles off Humboldt Bay. It’s a pretty good bet that the local harbor be retrofitted to meet the needs of future offshore wind projects, and, in fact, it’s already in the planning stage, with the help of federal dollars.

It’s not a big surprise that port communities in the U.S. seek to attract the wind energy industry, considering the example on economic development provided by the U.K.’s Grimsby. A University of Hull study found that the U.K. will be tripling direct and indirect jobs supported by the wind industry by 2030 and that Grimsby will more than triple its offshore workers to over 6,000 in that same period, while also adding thousands more indirect jobs in local businesses.