2018 was a good year to be in the railroad business. But was it a spike or the beginning of a long trend?

Overview: A Golden Spike

The year actually started a little soft before recovering with a strong finish. According to American Association of Railroads (AAR) the combined traffic for U.S. railroads was 28,113,490 combined carloads and intermodal units, a 3.7% increase over 2017.

Given the business disrupting Trump Administration’s tariffs – directly impacting freight traffic with both North American neighbors, Canada and Mexico – and the U.S. Government shutdown, the results are mildly surprising. Also, considering the move away from coal – the foremost commodity moved by rail – to other energy sources, this makes 2018 look like a particularly solid year for the railroads.

AAR Senior Vice President of Policy and Economics John T. Gray commenting on the 2018 U.S. traffic figures said, “U.S. freight rail traffic in 2018 was positive for the most part…Intermodal set a new annual record for the fifth time in the past six years, while carloads of chemicals and crushed stone, sand, and gravel set new annual records. Petroleum products also had a mild resurgence. For the year, 13 of the 20 commodity categories we track saw increased carloads. On the negative side, coal continued to suffer in 2018 from market forces that favor natural gas and renewables for electricity generation.”

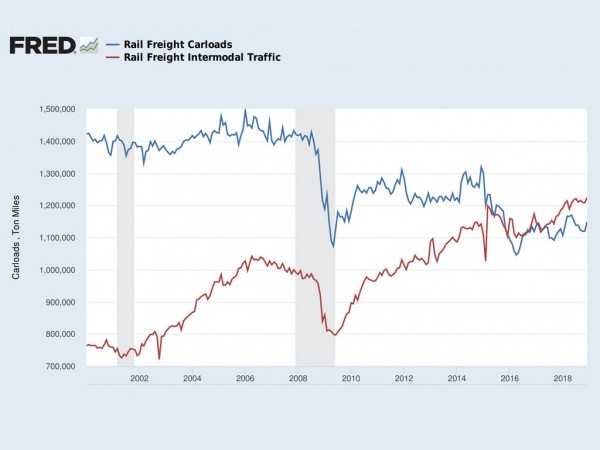

There are a number of reasons that rail prevailed in 2018. The economy growing at nearly 3% was perhaps the main reason but the driver trucking shortage and increased demand spilled over to rail, propelling the ever-rising intermodal segment [see Fredgraph].

2018 – A Better Result

BNSF: In 2010 Warren Buffett’s Berkshire Hathaway bought the Burlington Northern Santa Fe (BNSF) in the “Oracle of Omaha’s” first big venture into the rail sector. At the time, just coming out of the “Great Recession,” the acquisition appeared a risky venture, although as Buffett pointed out they already owned a significant number of shares of BNSF before the buyout. In year number nine since the buyout, Buffett indeed looks prescient. BNSF’s total revenues for 2018 were up 12%, compared to 2017. Average revenue per car/unit 6%, in 2018 as a result of increased rates per car/unit.

Some business segments had surprisingly good years. Agricultural Products volumes increased 9% in 2018 over the previous year, despite lackluster performances from soy and wheat. Strong export and domestic corn shipments, as well as higher fertilizer and other grain products helped make up the difference. Industrial Products also posted a strong year, as volumes increased 10% in 2018, attributable to a higher demand for petroleum products, building products, and plastics.

NS: Norfolk Southern Corporation (NS) also posted increases in operating revenues for the year. The railway reported operating revenues of $11.5 billion, an increase of 9% compared with 2017. NS said a boost in revenue per unit, including increased rates as well as higher fuel surcharge revenue and higher volumes lifted revenues. Overall volumes were up 4%, reflecting growth in the major commodity categories of intermodal and merchandise, which offset a decline in coal. Income from railway operations was $4 billion, a 12% increase year-over-year, and an all-time record.

James A. Squires, CEO of NS said the 2018 financial results, “clearly demonstrate improved financial performance and our commitment to delivering shareholder value… Our confidence to deliver improved value to our shareholders – as underscored by our recently announced dividend increase – is heightened by NS’ momentum heading into 2019 and by an array of initiatives to serve customers better and operate more efficiently.”

CP and CN: The well-founded optimism Squires expressed is industry-wide. Both Canadian rail operators, Canadian Pacific (CP) and Canadian National (CN) also recorded solid years.

Keith Creel, CP’s CEO noted, “The power of the CP operating model is evident in the strong performance across the company. We set records across many lines of business in 2018, including Canadian grain, potash and domestic intermodal.” Adding, “2018 was a record by almost every measure and will be remembered as a watershed year for our company,” said Creel. “Our record operating results are proof that the CP family is committed to making this company the best it has ever been.”

CN’s CEO JJ Ruest was happy with his company’s performance in 2018: “I’m very pleased with our fourth quarter results and the strong finish to 2018. With approximately C$1.3 billion of revenue growth in the final three quarters of the year, CN regained its position of strength and demonstrated again its ability to grow at low incremental cost. 2019 will be a year of building on this momentum.”

Union Pacific & CSX: Both Union Pacific (UP) and CSX reported higher earnings in 2018 with increased freight rates and the tax windfall boosting returns.

In 2018 CSX revenue hit $12.3 billion, an $842 million or 7% increase over 2017. CSX posted a big jump in operating income of $4.9 billion – a hefty $1.1 billion increase of 31% over 2017. The operating income in 2017 included a pre-tax $240 million restructuring charge and a pre-tax tax reform benefit of $142 million. Adjusting for these items, operating income increased $1.1 billion or 28% y-o-y.

The volume numbers for CSX were flat – only 1% above 2017 – but the revenue numbers were up 7%. A good example was fertilizer. The units (volume) were down 15% with total revenue off 5%. However, the revenue per unit was up 11% in 2018. A similar result was posted for forest products, 2018 was up 8% in volume and 13% in in total revenue. Intermodal, which is a big piece for CSX, was marginally up at 2% but total revenue was up a full 7% - the same increase as for coal another big-ticket item for the rail company.

Union Pacific (UP), like other Class 1 railroads, benefited from increased freight rates from greater demand and pressure on trucking. For the full year 2018, UP reported record net income of $6 billion, a 29% increase over 2017.

Operating revenue totaled $22.8 billion compared to $21.2 billion in 2017.

Operating income totaled $8.5 billion, a healthy 8% increase compared to 2017. UP’s freight revenues were also up 8% totaling $21.4 billion. The rail company’s carloadings were up 4% behind a strong performance in industrial and premium shipments.

Like the other Class 1 rail companies, UP is optimistic about 2019. UP Rail’s CEO Lane M. Fritz said, “We are optimistic that continued economic growth, improving service performance and the strength of our diverse franchise will drive positive volume and revenue growth in 2019. We expect operating margins will increase as a result of solid core pricing gains and significant productivity benefits from our G55+ 0 initiatives, including Unified Plan 2020.”

The Unified Plan 2020 was announced in September of 2018 and is a new operating plan that implements Precision Scheduled Railroading principles that nearly all the major railroads have embraced. Unified Plan 2020 will launch Oct. 1, 2020 and will be rolled out in phases across the entire Union Pacific rail network. The plan is an important part of Union Pacific’s objective of operating a safe, reliable and efficient railroad designed to achieve the company’s 60% operating ratio goal by 2020, on the way to achieving a 55% operating ratio.

Trend or Spike

Whether 2018 was a spike or trend for North American railroads is difficult to say. The U.S. tax windfall and the current pressure on trucking contributed to the strong performances in 2018. But 2019 and beyond could be determined by factors beyond the control of the railway companies.

As AAR’s John T. Gray said, “What happens in 2019 will depend on how the domestic and global economies hold up and the policies – particularly monetary and trade – that come out of our legislative and executive branches.”

_Alliance_-_127500_-_8518a8cb53bfa1ee3241a9389b0c47f7b53ad9ce_lqip.png)