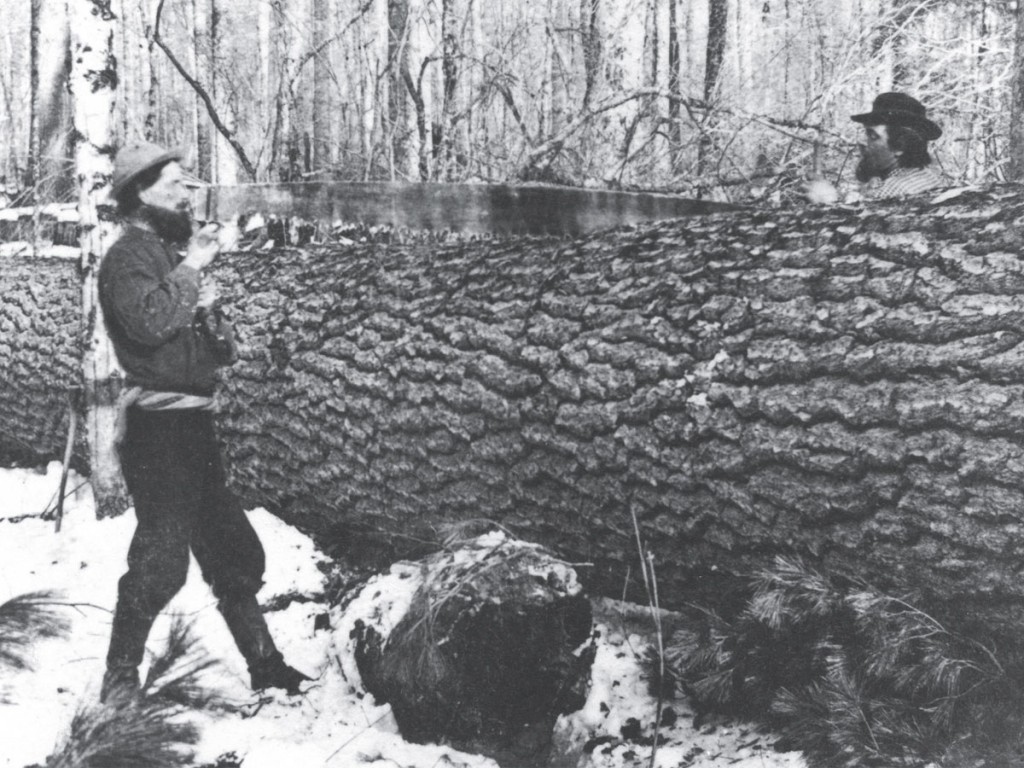

In the United States the two-man crosscut saw used for logging in the old days was nicknamed the ‘misery whip’ – aptly dubbed as day-long sawing with the device resulted in muscle-aching misery. And the four-decade old dispute between the U.S. and Canada is a lot like two lumberjacks pulling and pushing a crosscut saw on a tree to no avail – a peculiar diplomatic purgatory for both nations. A recent WTO decision found in favor of Canada but the US is likely to file an appeal pushing the whole dispute into limbo. This is happening against the backdrop of soaring lumber prices driven by increased demand and falling supplies.

In late August, a World Trade Organization (WTO) panel ruling on the four-decade old lumber dispute between Canada and the United States came down in favor of Canada on most of the substantive issues. Naturally, the Trump administration instantaneously expressed a desire to appeal the WTO decision –which has taken something of a backseat to the recent WTO declaration that some of the U.S. 301 tariffs placed on Chinese goods are illegal.

How long the lumber price boom will last is at this juncture an open question as demand in the Covid-19 economic environment has been notably fickle and the US-Canada decision itself could become a political firestorm given the Trump Administration’s absolute distain for the WTO and with the newly minted USMCA’s unity still untested.

The U.S.-Canada Whip Saw

For the better part of four decades the US and Canada, like two old grizzled lumberjacks working a whip saw on a mammoth tree, have gone back and forth trying to cut a deal on Canadian lumber exports to the US. A deal is important to both Canada and the United States as the US is the largest market for Canadian softwood and from the US perspective, Canada is the largest supplier. Yet as of August, the two sides look as far apart as at any time during the lumber dispute’s long history with little chance of resolution in sight.

This new round of talks began in 2017, when the last Canadian-American lumber agreement expired. The U.S. Department of Commerce levied countervailing duties on Canadian softwood lumber imports, arguing Canada’s lumber industry is unfairly subsidized by the Canadian government, as most of Canada’s lumber comes from publicly-owned forests, as opposed to the predominately private operations in the US. As a result, Canadian lumber exporters have reportedly paid close to $3.9 billion in duties to the US.

In August, the WTO’s three-person panel determined that the countervailing duties designed to offset Canadian subsidies were illegal as the US had not shown that the prices paid by Canadian lumber companies for timber on government-property was artificially low compared to the market and caused “material injury” to US lumber companies. With the WTO announcement, US Trade Representative Robert Lighthizer proffered a bitter rebuttal, “This flawed report confirms what the United States has been saying for years: the WTO dispute settlement system is being used to shield nonmarket practices and harm U.S. interests. The panel’s findings would prevent the United States from taking legitimate action in response to Canada’s pervasive subsidies for its softwood lumber industry.”

Naturally Canadian Minister of Natural Resources and Forestry, John Yakabuski’s remarks pushed the debate in another direction, “This [the panel decision] is an important step in ensuring the ongoing success of our forestry industries, which play an important part in our economy. As we move towards economic recovery, it has never been more important to vigorously defend and encourage this sector.”

Panel Discussions

Following the WTO’s August proclamation, by mandate, the US has sixty days to file an appeal – which would seem likely in view of the Trump Administration’s post-decision posturing.

If, as expected, the US files a challenge to the panel’s ruling, the case will be rendered into a legal limbo with the end result that the half a dozen Canadian lumber exporters to the US will be denied any tariff relief.

The matter is further complicated by the wrangling over the appellate panel. The WTO tribunal has been hindered by the loss of a quorum of members needed to consider trade rulings. In 2019 the US triggered panel paralysis following the loss of an appeal in which the US argued the appellate panel had exceeded its jurisdiction by ruling on issues the US considered to be outside its purview. Subsequently, the panel which originally consisted of nine members and needed five to function was through attrition reduced to four and finally only three members that took part in the decision. The US blocked replacing the vacated seats, leaving the panel short of a quorum. This neutralized the panel and left the status quo – US tariffs – in place.

To counter the panel paralysis, the EU, Canada, China and other WTO members established an interim arbitration system to reconcile trade disputes. Thus, the WTO panel was then given permission to function without a quorum which in turn was appealed by the US – an appeal that was denied setting the stage for the August lumber ruling and the US response.

The ruling also comes at a potentially vexing time for US-Canada trade relations. While the USMCA promised to improve trans-border trade, the Trump administration recently decided to restore a 10% “national security” tariff on exports of Canadian aluminum, accusing the northern neighbor of violating the terms of the 2018 agreement that saw steel and aluminum tariffs rescinded. The Trump Administration eventually backed off the tariffs but the serendipitous behavior still stings in Canada. And there are wider issues. Given the administration’s distain for the WTO, the lumber dispute could well become a pretense for the US to drop out of the international forum and an unraveling of the international trading system.

Market Demand

Against this gloomy political backdrop, business is booming for lumber and lumber products. Lumber product prices are soaring as a result of a rebound in demand coupled with tightened supplies due to Covid-19 impacts on mill production earlier in the year and the recent wild fires in the Western parts of the US.

After a dismal Covid-19 start to the year, pent-up demand in the form of new housing starts and private DIY (Do-It-Yourself) renovations, fueled in part by government Covid-19 checks, has turned a bust to boom, for forest products industry.

The Forest2Market newsletter, in their August edition reported “Over the last three weeks, prices for southern yellow pine lumber have pushed past the all-time highs of mid-2018. Now, 15 weeks after bottoming during the peak of the pandemic, SYP lumber prices have soared an astounding 75% and have broken the previous record achieved during 2018.”

WRI Market Insights in their September issue dittoed the assessment, commenting, “US softwood lumber prices have risen spectacularly this year. Market prices for commonly traded grades have more than doubled from May to August.” Adding, “Record high lumber prices in the US and slightly lower costs for sawlogs moved 2Q/20 gross margins for US sawmills to some of the highest levels seen since 2005.”

Madison’s Lumber Reporter (September 17 2020) chipped in with their similar analysis of the boom market:

“Prices for this construction framing dimension softwood lumber item is up an incredible +$214, or +29% from one month ago, when it was US$746 mfbm [Multiple of the Foot, Board Measure]. Compared to mid-September 2019, this price is up an astonishing +$584, or +155%. With the weekly price dropping for the first time in many months, compared to one-year-ago last week’s Western S-P-F 2×4 price rose by +$503, or +110%, relative to the 1-year rolling average price of US$457 mfbm and was up +$544, or +137%, compared to the 2-year rolling average prices of US$411 mfbm.”

International Markets

Another factor driving up demand is China. With the “Phase One” of the US-China trade pact, hardwood lumber products (under the manufactured goods portion of the deal) are inked for a $77.7 billion increase in exports to China – over the pact’s established baseline of exports in 2017 – through 2021. The Trump Administration’s tariff war with China put a duty of up to 25% on US hardwood exports, effectively cutting US hardwoods out of the China market. Opening up the China market – even if it doesn’t hit the Phase One benchmarks – will have an enormous impact on the forest products industry. Back in 2018 the US exported nearly $2 billion in hardwood products to China. A total that represented almost half of the total US grade lumber produced and 10% of the US agricultural goods exported to China, according to the Hardwood Export Council (HEC).

Although China is clearly the “elephant in the room,” US exports to other countries are also picking up. For example, Vietnam has emerged as a major market for US forest product exports. According to the US Foreign Agricultural Service (FAS), Vietnam’s wood processing sector is “heavily import-dependent” and in 2019 with purchases of $350 million in American hardwoods was the 3rd largest market for the US. According to FAS, 90% of the exports were logs and timber, “For logs, oak, walnut, and ash are the most popular species, with exports totaling $65 million. For timber, poplar, oak, walnut, and alder are the best-selling species, totaling $210 million,” the US agency reported.

Another emerging market for US forest product exports is India. In 2019, the US posted a record year for U.S. hardwood exports to India with the value of hardwood lumber and veneer exports totaling USD 6.448 million, according to the AHEC. Hardwood exports in 2019 from the US from 2019 to India increased by a whopping 72% in value to $2.356 million (up from $1.369 million in 2018) and by 140% in volume to 4,082 cu/m (up from 1,698 cu/m in 2018). The top six American hardwood species exported last year were hickory ($727,000 and 1,229 m3), red oak ($466,000 and 920 m3), walnut ($329,000 and 282 m3), white oak ($262,000 and 358m3), ash ($242,000 and 356m3) and maple ($140,000 and 240 m3).

With the domestic demand in the US booming, international exports rising, supplies pinched and prices soaring the forest product sector is doing well despite the pandemic. But a crucial problem remains – when will the US and Canada finally get a deal done on lumber as the current situation just doesn’t cut it.