The dry bulk shipping market is experiencing a boom market that extends from the largest classes of ore carriers down to even handy-sized carriers (see chart). Multipurpose vessels (MPVs or MPPs) – ships that are self-loading and under 60,000 dwt – which are the workhorses of the breakbulk industry are somewhat of an operational outlier compared to other classes. The larger ships are largely dedicated to a single commodity and are loaded and discharged at specialized facilities. Ore carriers like the Valemax class can exceed 400,000 dwt and run from Brazil to China with virtually no backhaul.

They operate on economy-of-scale concept where operational flexibility has little importance. Conversely, MPPs stress operational flexibility with their ability to handle various types of freight, including cargo out of gauge, like wind power components. The downside to the operation of MPPs is the constant demand to find freight over multiple calls and routes – mixing and matching to meet the vessels’ ROI.

The market for MPPs often is tied to “projects” and if investment isn’t being made in projects then the sector has a tendency to bump along with relatively low returns compared to other dry bulk sectors that are influenced by other economic trends. But this time is different.

The demand has been so pervasive through nearly every class of ships that the freights for MPPs have been lifted like ships in a high tide.

Hamburg, Germany-based shipbroker Toepfer Transport in their March market newsletter explained the phenomena, “So far, the shipping markets keep on surprising us. The boom in the bulk markets has also come as a surprise to most market participants. Few owners actually positioned themselves strategically for the current boom. The MPP/Heavylift markets are also really accelerating and finally starting to provide healthy returns.”

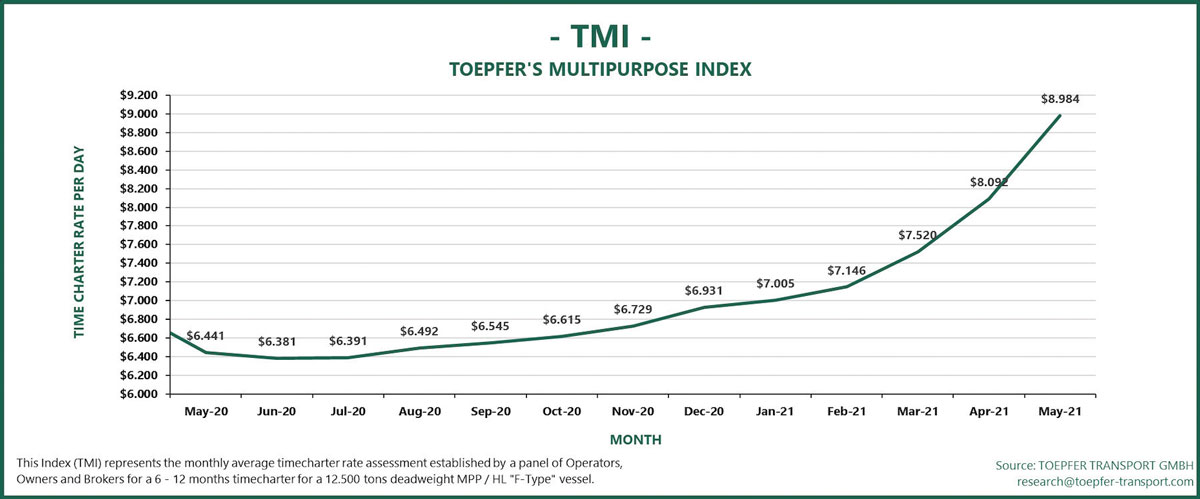

Toepfer also publishes a unique index tracking (see chart page 14) daily charter rates for MPPs. And in their May 20th index, Toepfer’s TMI was $8,984, up from $6,441 a year earlier. The rise in the TMI has been consistent since June 2020 ($6,381) and really started to accelerate in January.

But the recent rise in MPP fortunes doesn’t come without some caution.

London-based Drewry, a shipping consultancy company, in their recently released Multipurpose Shipping Annual Review & Forecast, while noting, “In March one-year time charter rates for multipurpose (MPV) tonnage, incorporating both breakbulk and heavylift ships, reached their highest level in almost six years.” But Drewry’s Senior Analyst for Multipurpose & Breakbulk Shipping Susan Oatway proffered the caveat, “The recent rally in multipurpose earnings represents a climb out of one of the longest recessions in recent history in this cyclical market.”

Oatway was noting that the MPP sector “despite this rally earnings remain low by historical standards, off 40% from their all-time peak of 2007,” which occurred during the last big boom for dry cargo freight when the BDI topped 11,793 (see Super Cycle page 13).

While 2007 was an economic outlier for the entire dry bulk sector, the long term key to MPP profits remains hitched to finding freight that fits the ships’ service niche. Probably, the most buoyant opportunity near-term is in the vast potential of North American offshore wind – especially in the Northeast. With multi-million dollar projects already inked MPPs will be needed to move massive amounts of project equipment. And it isn’t just in the U.S. as wind power projects offshore and onshore are picking up with increasing frequency as governments’ address environmental concerns.

So, can the MPPs continue to track upward, say even after the containerships rates fall and freight poaching begins in earnest?

At the moment, it would appear that the answer may well be blowing in the wind.