Descartes-Datamyne recently published a series of trade reports under the moniker “Big Book” that delve into the impacts in 2020 of the COVID-19 pandemic on U.S. imports. The various reports provide a unique analysis tool for measuring the effect that the pandemic has had on U.S. trade.

The “Big Book” was designed to be a trade analysis tool for analyzing the impacts that the COVID-19 pandemic had on U.S. commodity imports. The data was drawn from the U.S. Census and Bills of Lading with the 2020 data measured in a year-on-year basis against pre-pandemic 2019. Descartes-Datamyne (www.datamyne.com) is a provider of what is arguably the world’s largest searchable trade data base covering 230 markets across five continents which enables companies to put together a comprehensive picture of international trade flows.

But it’s clear from the data that some commodity groups were harder hit than others. And now as round two of the pandemic takes hold in the U.S. in the fourth quarter, will a similar pattern emerge or have global conditions changed enough to alter the impacts?

COVID & Base Commodities

Although the impact on retail product imports (consumer goods) offers the most visible manifestation of the pandemic’s impact to the public – store shelves tell it all – delving a little deeper into “base” commodities like minerals and agricultural products provides a more comprehensive view of the effect of the pandemic on industry and commerce.

One of the most highly impacted import sectors was minerals. According to Descartes-Datamyne’s data, in terms of value, (mineral) imports fell by 39.33%. “Collectively, that amounted to a more than $40 billion decline in value compared to 2019,” the trade data company reported. Although petrol and petroleum related products were the hardest hit (accounting for over 90% of value in dollars) both iron ore and coal imports – steel making commodities – were also significantly down. Iron ore was off over 38% and iron another 31%. Both data points reflecting the impacts on steel making in the U.S. (see Buxbaum article Steel’s pandemic outlook: better than expected).

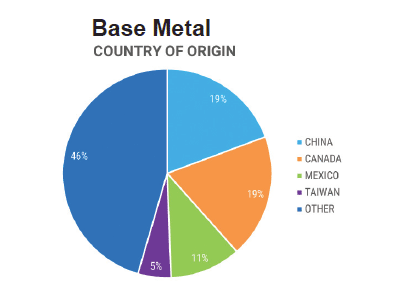

And the impact of COVID spread across the entire metal manufacturing sector. Imports of unwrought aluminum (a point of contention with Canada and China) was off nearly 19% with roughly $5 billion in imports in 2019 compared to just over $4 billion in 2020. Aluminum sheets were off even more at over 39%. Steel and iron products were substantially down as well, $3.2 billion in 2019 to $2.783 billion in 2020, a 15.7% drop. This is not a surprising drop considering the shut downs in the auto manufacturing in the U.S., Asia, Europe and Mexico.

The declines in the auto sector also hit home with other commodities. Take the case of tires. Pneumatic tires hit nearly $8.6 billion in 2019 but fell to $6.7 billion in 2020 – a nearly 22% drop for the year-on-year tally. For articles of unhardened vulcanized rubber (the basic rubber of material molding for articles like gaskets, etc.), imports were dropped over 19% from $2.5 billion in 2019 to $2 billion in 2020. Another item impacted by the auto manufacturing shutdowns was safety glass. In 2019 imports of safety glass nearly hit $656.7 million but fell to $476.3 million in 2019, a drop of over 27%. Vehicles themselves also reflected the downward trend [see AJOT issue #714 Oct. 24-Nov. 8, Automotive Logistics: Rubber band effect US demand for auto imports snaps back] although has since rebounded. Motor vehicles were off over 34% [$104.2 billion 2019 - $68.5 billion 2020], trucks nearly 32% and trailers and semis over 23%.

Tariffs and COVID

Although tariffs have played some role in the falloff of these imports, in looking at the monthly charts for both years [2019-2020] the import patterns remained fairly similar period to period, meaning it likely was more a pandemic driven drop than a tariff war fallout.

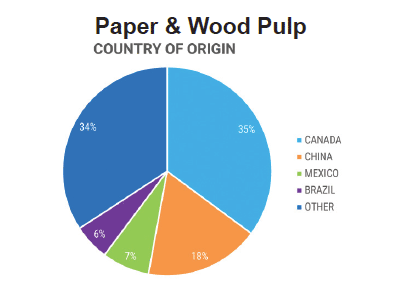

Another import that caught the attention of the American public was toilet paper and similar products. Unlike most commodities, toilet paper was significantly up by 15.54% [$880 million 2020 to $762 million 2019]. As the Big Book noted the reason for the boom was, “Early during the pandemic, many consumers were seeking out and hoarding paper products, creating a false scarcity.”

Other paper related commodities followed the general downward trend. For example, chemical wood pulp was down nearly 30% for the period [$2 billion in 2019 to $1.43 billion in 2020]. Various types of paperboard also posted double digit or near double digit declines. Among the largest losers was uncoated paperboard which fell by over 28% [$1.3 billion 2020 to $930 million 2020]. Even printed material and paper for printing was unexpectedly down as Descartes-Datamyne wrote: “Surprisingly during an election year, imports of printed material under [HS 4901] have seen the sharpest decline in FOB value, falling 33.2% compared to the same period in 2019.”

In this case, the question is whether the demand was down because of the pandemic or is this the new normal with the accelerated rise of the digital economy?