South China’s Port of Nansha rising to meet cold chain logistics demand with leading-edge mega-warehouse

In the wake of COVID-19 pandemic shocks, global demand is soaring for warehousing – in particular for leading-edge facilities meeting vital needs close to major markets.

South China’s Port of Nansha, among the world’s five busiest containerports, is rising to meet cold chain logistics challenges with an ultramodern mega-warehouse complex to encompass six massive eight-story buildings with a combined storage capacity of nearly 500,000 tons.

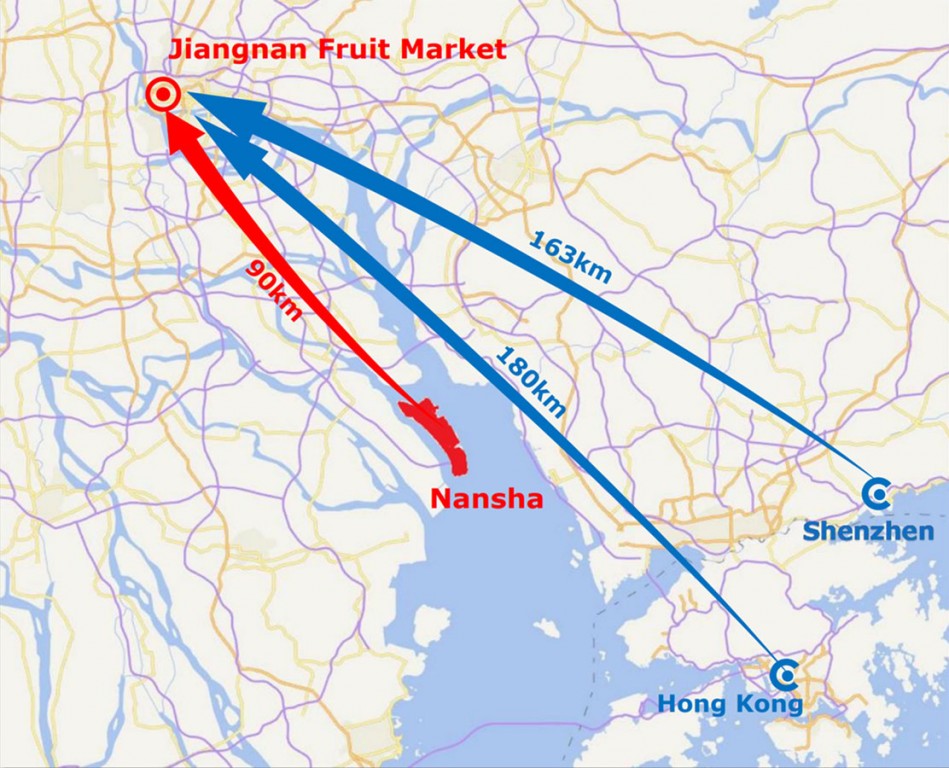

The Nansha International Logistics Center site adjoins the port’s expanding automated terminal facilities and is proximate to the bustling Jiangnan Fruit Market in Guangzhou (formerly Canton) and key population centers throughout the Pearl River Delta, from Shenzhen to Hong Kong and Macao.

Completion slated by mid-2021

With first-phase completion on target for March 2021, Port of Nansha’s largest-in-region cold chain logistics installation, while on the drawing board for more than two years, is indeed coming online at a propitious time.

Chris Swartz, director of global transportation and logistics service for AJC International Inc., an Atlanta-based world leader in shipping of poultry and other frozen and refrigerated protein products across six continents, is among industry veterans sold on the endeavor’s vast potential.

Never has safe, expedient cold chain logistics been more crucial than today, Swartz says, citing not only the impacts of COVID-19 but also African swine fever virus and other infectious diseases.

Shipper sees complex as visionary

Swartz believes the new Nansha cold chain complex is a visionary investment, providing an ideal gateway for proteins coming into China – the world’s No. 1 importer of such commodities – at the forefront of a broad spectrum of frozen and refrigerated goods from throughout the world. Meanwhile, top temperature-sensitive exports from Nansha include a wide range of seafood.

Among fresh cargos already enjoying expedited customs clearance and rapid transit to market via Port of Nansha are cherries from Chile and citrus fruits from the U.S. West Coast. The addition of the new cold chain logistics hub promises to further enhance productive service levels and dramatically expand opportunities through integrated one-stop offering of such functions as inspection, storage, processing, repackaging and distribution, all within specific temperature-maintained environments.

The cold supply chain has long been underserved and underinvested on a global basis, according to Swartz, so he sees the latest infrastructure endeavor at the Port of Nansha as a much-needed game-changer, a win-win proposition benefiting cargo owners and consumers alike.

Big trucking cost savings offered

The three-building first phase of the cold logistics complex, comprising 305,000 square meters (3.3 million square feet), represents an investment of 1.87 billion Chinese yuan (US$260 million) and is to deliver a warehousing capacity of 230,000 tons, according to John L. Painter, chief executive officer of Guangzhou Port America Inc., Port of Nansha’s Wyckoff, New Jersey-based North American arm. The three-building second phase is similar in scope, bringing total investment to more than US$500 million and overall capacity to a whopping 460,000 tons.

The new mega-warehouse hub isn’t the only trailblazing project under way at the Guangzhou Port Group’s Port of Nansha. A fourth fully automated marine terminal bodes to boost the port’s contingent of ship-to-shore cranes to 78 from the current 65, while soon-to-be-completed on-dock rail access augurs to furnish direct train links to such inland cities as Changsha, Wuhan, Chongqing and Kunming.

For temperature-controlled loads moving inland by truck, Port of Nansha provides cost savings of as much as 5,000 to 6,000 Chinese yuan (US$700 to US$850) per container compared with other Pearl River Delta ports, like Hong Kong, according to Painter. What’s more, Port of Nansha’s affordable labor costs and terminal charges are typically less than those of congestion-plagued competitors, and Hong Kong’s presently precarious political situation adds to incentives for shippers to turn to Nansha.

Geography favors Port of Nansha

In addition to being closest to Guangzhou’s Jiangnan Fruit Market, Port of Nansha is in an increasingly preferred geographical position as manufacturing and population continue to migrate to the west side of South China’s Pearl River Delta, where Nansha remains the only deepwater containerport. This dynamic region includes such vibrant cities as Foshan, Jiangmen and Zhongshan.

With alongside depth of 17.4 meters (57 feet), Port of Nansha can easily accommodate the largest container vessels of today and tomorrow. Dedication of the 65-square-kilometer (25-square-mile) island port solely to shipping and logistics, without urban conflict, combines with automation-driven technological efficiencies to help facilitate swift truck turn times of as few as 30 minutes, without unnecessary waste of time waiting outside terminal gates.

Emerging as the Jewel of the West Pearl River Delta, Port of Nansha is further bolstering its role as South China’s leading port for cold chain logistics as its mega-warehouse hub for temperature-controlled cargos advances toward completion.