The Port of Virginia offering unique U.S. West Coast link

A uniquely innovative service is relying on The Port of Virginia as a gateway for delivering import cargo to the U.S. West Coast.

The next-generation twist on landbridging commenced in April – supported by The Port of Virginia, global ocean carrier Hapag-Lloyd and Class I rail partner Norfolk Southern – as a solution for shippers to avoid major congestion-and-delay hot spots and dependably deliver imported goods to California.

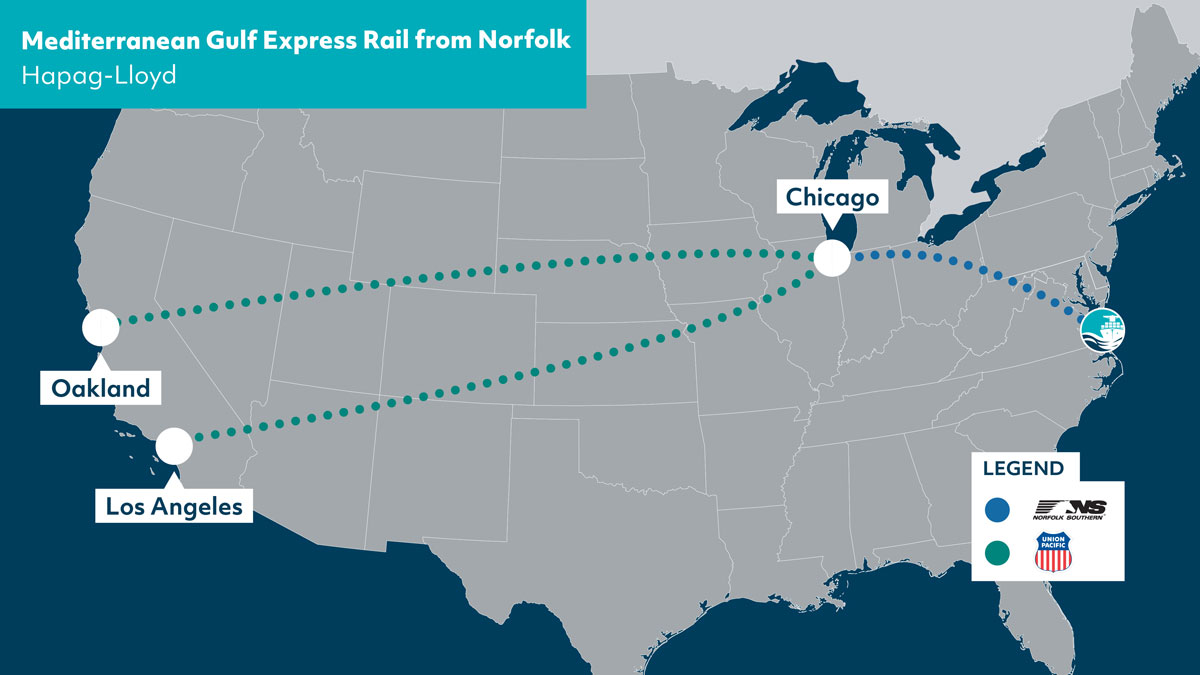

Containers arriving weekly from Europe on Hapag-Lloyd containerships at Norfolk International Terminals (NIT) are double-stacked on Norfolk Southern trains for transport to Chicago, where they are switched to Union Pacific rail for delivery to Los Angeles and Oakland – thus avoiding California port congestion and Panama Canal transit.

First-of-its-kind service

“This is the first time I’ve seen an initiative of this nature in an established trade,” said Thomas D. Capozzi, chief sales and marketing officer of Virginia International Terminals LLC, the Virginia Port Authority’s private terminal-operating subsidiary. Capozzi is in his 22nd year as a port executive following 10 years with ocean carriers.

“In today’s super-challenging trade environment, shippers are seeking dependable ways to efficiently get goods to destination, and this visionary service turns tradition on its head to dependably deliver an inventive solution,” Capozzi said, noting that transcontinental intermodal services customarily have moved containers from west to east – not vice versa.

Indeed, the efficiencies of The Port of Virginia and its expanding intermodal rail capacity were keys to the Hapag-Lloyd decision to replace its Mediterranean Pacific Service (MPS) with the new Mediterranean Gulf Express (MGX), introducing the Norfolk call to its rotation from the ports of Livorno and Genoa in Italy and the Spanish hubs of Barcelona and Valencia.

Partners are all aboard

Norfolk Southern’s vice president of intermodal and automotive marketing, Shawn Tureman, is all aboard with the resourceful solution.

“Supply chain challenges have led shippers and carriers to diversify their networks,” Tureman said. “In response, our team took a customer-centric approach by formulating a partnership with Hapag-Lloyd and Union Pacific to deploy a new landbridge service.

“The OceaNS Bridge Express (OBE) offers Hapag-Lloyd customers an efficient coast-to-coast product for getting their containers to the western United States,” he continued. “The OBE service will also help ocean carriers like Hapag-Lloyd better utilize vessels within their ship rotation strategy. With ocean carriers looking to have capacity shift from the West Coast to the East Coast, this new rail service will showcase our collective abilities to move containers quickly from an East Coast origin to the west.”

In announcing its weekly MGX service, operating with eight Panamax vessels, Hapag-Lloyd executives pointed to its ability to furnish shippers efficient planning with realistic schedule reliability.

The service commenced with the mid-April arrival at NIT of Hapag-Lloyd’s Synergy Antwerp. Nearly 750 containers from that vessel were loaded on NS trains for Chicago, with the UP handling the final delivery to California.

Well-timed endeavors

The Port of Virginia’s Capozzi said he sees the new east-to-west offering perfectly coinciding with expansion of the already-impressive intermodal rail capabilities at NIT and throughout the Virginia seaport complex.

“While The Port of Virginia has proficiently maintained cargo flows through unprecedented times during the COVID-19 pandemic and has plenty of existing capacity to comfortably accommodate present demand,” Capozzi said, “extensive infrastructure investments are building capacity for decades to come.”

On target for completion by late 2023 is the $90 million endeavor to increase NIT’s annual rail throughput capability to 610,000 units from the current 350,000 units, bringing The Port of Virginia’s overall yearly lift capacity to 1.1 million rail units.

With containerized cargo volumes at The Port of Virginia growing by more than 25 percent on a year-over-year basis – and rail lifts rising by 28 percent – the rail facility investments are coming at an opportune time.

At the same time, The Port of Virginia continues to consistently provide industry-leading turn times of less than 50 minutes for truck moves through its ultramodern, semiautomated marine terminals, thanks in part to cutting-edge appointment system technology.

$1.3 billion in investments

The rail enhancements are just part of $1.3 billion in infrastructure investments being made between now and 2025 by The Port of Virginia, which also is modernizing and renovating two berths and converting them to rail-mounted-gantry operations and is deepening channels to 55 feet while widening them to safely handle two-way traffic of ultralarge containerships.

“The Port of Virginia joins its ocean carrier and Class I rail partners in enthusiastically providing shippers with a revolutionary solution to the supply chain challenges of today and tomorrow,” Capozzi said. “Shippers from the Mediterranean to the U.S. West Coast no longer have to be at the mercy of delays involved with transiting the Panama Canal and congestion at California port facilities.

“We look forward,” he said, “to further ground-breaking collaborations that redefine the supply chain to the benefit of cargo owners looking to dependably get product to destination without undue delays.”