Closely watched gauges of manufacturing in Europe and Asia fell amid intensifying fallout from the war in Ukraine and an economic slowdown in China.

The purchasing managers index for the 19-nation euro zone slipped to 49.6 in August from 49.8 in July, according to S&P Global -- a reflection of dwindling demand as consumers face surging costs for energy and a broadening range of goods and services.

Germany and Italy both saw the worst readings in 26 months.

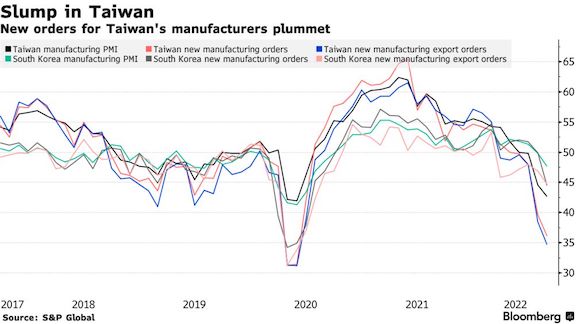

In Asia, Taiwan’s PMI fell to 42.7 -- its lowest since May 2020 -- while South Korea’s declined to 47.6 -- the worst since July 2020. Japan weakened too, though remained above the level of 50 that separates contraction from expansion.

A drop in new orders to Taiwanese firms indicates the decline seen in export orders in July is continuing. A series of chipmakers have warned recently of slowing demand for semiconductors, which are a key export from both Taiwan and South Korea.

The data add to a highly uncertain global environment as the world’s two biggest economies move in different directions and most central bankers push interest rates higher to fight soaring prices. The hit to factory output from some of the world’s biggest trading hubs is a key warning for demand as inflation weighs on households.

For the euro area, the chances of a recession are increasing by the day as Russia curtails energy shipments, stoking steep gains in prices for natural gas and power. Despite the gloomy outlook, the European Central Bank is expected to keep raising rates to contain the hottest inflation since the creation of the common currency.

“Forward-looking indicators suggest that the downturn is likely to intensify -- potentially markedly -- in coming months, meaning recession risks have risen,” S&P Global economist Chris Williamson said.

Over in Asia, firms in South Korea -- a bellwether for global trade -- “often commented on concerns that the economy would continue to perform poorly amid weak demand and challenging global economic conditions,” S&P Global Market Intelligence economist Usamah Bhatti said.

Shipments of Korean semiconductors fell for the first time in more than two years last month, dropping 7.8% from a year ago, according to official data released Thursday. Chips comprise about 20% of South Korea’s exports by value, but the drop was compensated for by other goods, with total exports rising 6.6%.

“Concern that the economic slowdown would deepen grew among manufacturers, while businesses also noted the lingering impact of inflation and the war in Ukraine,” pushing the level of positive sentiment down to the lowest since last October, Bhatti said.

There was also more evidence of weakness in Chinese manufacturing. Factory activity shrank in August, a private survey showed, suggesting fallout from power shortages and Covid outbreaks is hitting smaller firms alongside large and state-owned ones.

The Caixin Manufacturing PMI fell to 49.5 last month from 50.4 in July, according to a statement Thursday from Caixin and S&P Global. That reading matched official data released Wednesday that showed activity contracted for a second month in August. The official manufacturing PMI inched up to 49.4 from 49.

A boost to Asia exports from China’s initial reopening from bruising lockdowns is now fading, with shipments likely to weaken further, according to Alex Holmes, a senior economist at Oxford Economics Ltd.

“This adds weight to our view that Asian export growth will return to its broad decelerating trend in the second half, as the external sector cools due to faltering global demand,” he said in a report.