Midst a devastating pandemic that’s crippling economies worldwide, here’s a Port of Oakland bright spot: meat exports to Asia. The Port said today its meat exports jumped 26 percent in the first quarter of 2020 over Q1 2019.

The Port said it now controls 42 percent of the market for meat exports leaving U.S. West Coast ports. Its nearest competitor, the Port of Long Beach, has 31 percent of the market.

The Port said it’s too soon to know if it can sustain bullish growth while coronavirus rattles global markets. But anything resembling Q1 performance would reaffirm Oakland’s big bet this decade on refrigerated exports. The Port and business partners invested millions on facilities that handle refrigerated shipments, known as “cool cargo.” The payoff: Oakland exported the equivalent of 15,000 20-foot containers of meat in Q1.

“That’s a gratifying number in the middle of a pandemic,” said Port of Oakland Acting Maritime Director Delphine Prevost. “But there’s still uncertainty about the implications of this health crisis on our business. We are monitoring our business closely.”

Oakland’s total cargo volume is down 5 percent in 2020 due to coronavirus, the Port said. Exports, up 3.7 percent, have helped soften the blow. The Port said meat shipments – beef, pork and poultry - now account for 10 percent of total export volume.

Oakland listed three reasons for its booming business in shipping refrigerated cargo overseas:

• Asian demand: As middle-class economies spread throughout Asia, the desire for high-quality U.S. products, especially farm goods, grows.

• Location: Oakland is the closest export gateway for California Central Valley growers and connects by rail to Midwest producers.

• Ship schedules: Container ships headed to Asia stop first in Southern California, then in Oakland before crossing the Pacific. Exporters prefer to load perishables at the last possible moment in Oakland to extend shelf life.

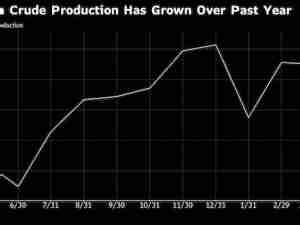

The Port said it has increased meat export volume 51 percent in the past three years. The biggest growth markets: China, Taiwan, Australia, South Korea and Japan.

China trade benefited from a tariff cease-fire with the U.S. early this year, the Port pointed out. It was also spurred by pork shortages in China. The Port said that the coronavirus impact on U.S. meat production has not been as severe as originally anticipated.